Just How Badly Does Money Want To Be Free?

Hey, remember how we saw that Wired piece on Money Wanting To Be Free coming down the pike and we were like, uh, oh boy? Hey, it is here now! And it asks: “What if people could transfer money over Twitter for next to nothing, simply by typing a username and a dollar amount?” Well, what if I could shit gold coins, and pay people simply by pulling down my pants? That is totally possible as well, if I swallowed a bunch of gold coins and then had the ability to excrete at will. Let’s make this happen, people! Okay, but seriously, it’s fair to agree with Wired that we are maybe, maybe, sorta on the brink of undermining the massive, unfriendly and filthy rich credit systems of the world-and that would/will be wonderful, when it starts to work.

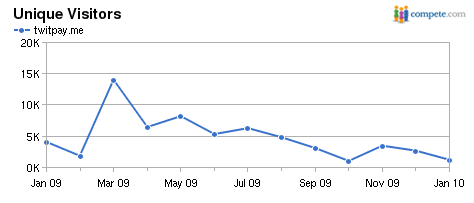

Unfortunately, what we have as a working example now is PayPal, which has its ups and downs. And in practice? They aren’t so different, in a few ways, from the big credit card vendors. Remember last year? “Starting in June, Paypal started assessing a fee of 2.9% on on purchases marked ‘goods or services’ to personal accounts.” And while the next PayPal evolution is Twitpay, which apparently has all of 15,000 users and seems essentially, so far, to be a way to notify people that you’ve made a PayPal payment to them, by means of Twitter, there’s definitely something in there. Also it does not seem to be taking off quite like wildfire?

But it could! Then the money will be totally in the Twitter machines… which surely will go well.

And then also there’s that new thing which you plug into your iPhone to make it into… a credit card reader. Which seems like the very definition of a transitional development.

But, yes, sure! We are going to get there! We all do want to get there. There may come a time when we are not beholden to fee-gouging, money-hoarding, float-subsisting mega-banks!