Poor Hank Paulson: Things Are Actually Worse Now Than Five Years Ago!

Five years ago, the economy nearly collapsed — and no one felt the impact more than Hank Paulson | http://t.co/l8ykzoDnOJ

— Businessweek (@BW) September 12, 2013

Bloomberg Businessweek goes huge today, observing, give or take, a peg for the five-year anniversary of the “financial crisis.” Oh mercy. What a tweet that is. Here is when we make a hero of Hank Paulson, the man who ping-ponged from the Pentagon to the Nixon White House to Goldman Sachs to the oversee the actual death of business as we knew it, with a in his own words biography. Which is fascinating, to be sure! It avoids the trouble of putting it in the words of reporters, who wouldn’t have an interest in how the tale is told. And so you get this, which is rather more interesting and horrifying:

So we designed a program that didn’t separate the healthy banks from the banks under duress, and we moved quickly to inject capital into hundreds of banks to recapitalize our financial system and restore confidence.

The only way we knew to do this was to put forward a program that would be attractive to the financial institutions, so they all would be encouraged to take capital for the good of the country.

There’s a real winner of an ending: “And at the end of the day, more capital is the best defense against bank failure.” I… well… uh. Banks with more money are more likely to be more bankey? Sure.

Still, at the end, Paulson agrees with most of us though! “Now a number of things that we were forced to do during this crisis made the problem worse, beginning with big banks…. When I came to Washington, Fannie or Freddie guaranteed or insured roughly half the new mortgages in America. Today about 90 percent of all new mortgages are insured by the government. So today it’s worse.” Haha. FIVE YEARS LATER: EVERYTHING IS WORSE. SORRY, MY BAD.

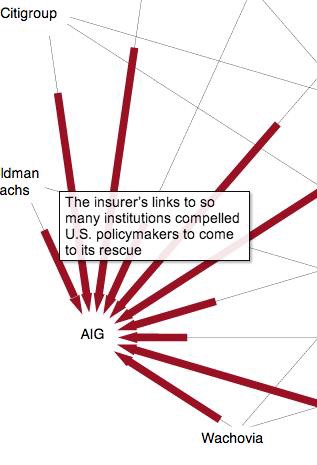

And the magazine has the most ridiculous graph!

What meaningless data charting! Here, we can say it more plainly with words: Goldman Sachs would not exist today without the rescue of AIG. Put that in your chart and smoke it.

If you want a slightly more gratifying story, their Where In The World Is Dick Fuld? profile might help.