Here's What Happens If You Don't Do Your Taxes

You, yes you, can do your taxes this year. Many of you are done, most of you haven’t started, and a few of you are freaking out. Some of you are thinking: what if I just don’t file? What will happen if I don’t pay? What if I didn’t file last year or the year before that? What will they do to me and will I be in prison with Wesley Snipes?

I have some answers to those questions! You should note that I am not a tax professional, that this is definitely not professional advice and that every situation is unique. Also you should be doing your taxes right now probably, not reading the Internet. But here’s some experience, offered person-to-person, that is not professional counsel.

It is better to do a cruddy job and file than to not file.

When I say “cruddy job,” I don’t mean “making wild guesstimations” or being dishonest. I mean: If you can’t nail some stuff down, forget about it and move on. For instance: Do you not have receipts for some expenses? Big deal: cut them out and forget about it. (These small expense-deductions don’t generally have too much effect on your tax burden anyway.) Err on the side of “hurting” yourself and just plow through it. It’s just not worth making yourself crazy over fifteen bucks!

You can fix your return!

It is easy to amend a return. It’s also easy for the IRS to amend your return: “You do not need to file an amended return due to math errors. The IRS will automatically make that correction.” Intense, right?

It is better to file and not pay than to not file and not pay.

What happened, you spend all your money? That’s okay, pal! Do your taxes, send ’em in, if you have absolutely no money. You will incur not-totally-crazy penalties over time due to not paying, and they will want to talk to you about when you can pay. (Yup, it’s always the broke people that have to pay more in this world.) That’s not ideal, sure! But it’s a lot more ideal than not having filed.

Okay, but should I be scared of the IRS?

The IRS only wants to hear from you. The answer, surprisingly, is a very firm “no”! Not at all! The IRS has some of the nicest, most understanding people I have ever spoken with in my life. True fact.

There’s a lot of TV- and movie-propagated terror about the IRS. (As well, the whole idea of the government and money is anxiety-producing on its own, sure.) And the truth is… well, they kind of used to be a little mean? But that’s actually ancient history. The people at the IRS are some of the funnest people ever! I have had long hilarious conversations with them on the phone. (For real, there are some hilarious ladies down in Atlanta.) IRS employees are like most civil servants; they deal with confused, freaked out and sometimes very dingbatty people (not you, friend!) every day — the kind of people who do not follow directions, particularly. So if you are not a jerk, they will be delighted to speak to you, at length. They will sometimes be like, “Girl, how did you get into this trouble?” and you’ll be like “Oh, haha, I’m a mess! Mistakes happen!” and they’ll be like, “I hear you! I get it!” Do not be afraid. What they want is to hear from you.

Should I be scared of my state tax department?

Actually… well, maybe just a little. The same rules apply as above — they do want to hear from you! — but, for instance, the New York State Department of Taxation and Finance seems to be a little cranky. They want their money, they want it now, and if you don’t give it to them, they will take it. I’m sure there are some wonderful, caring people working in all of America’s fine state tax departments!

What happens if you don’t file?

Have I mentioned that the IRS only wants to hear from you?

No really, what happens if you don’t file and don’t pay?

Great news! Eventually the IRS will do your taxes for you. This is called a substitute return. Doesn’t that sound nice? Well it’s not particularly. For an agency that’s devoted to taxes, they don’t do a very good job at it. (Kidding.) So the good news is that your taxes will be done! The bad news is that they will take your reported income, slot it into the appropriate tax bracket, and say you owe that percentage. So if you made $85,000, bam, you owe 28%.

Also? Lots of people can’t deal with taxes when they’re even going to get money back! People are funny. But you should know that your refund disappears in three years if you don’t file.

What happens if, like, I ignore the IRS?

Well, you’ll get a ton of mail. And the problem with being “in trouble” is that your sense of being in trouble fades really fast. That’s how people are built. Most people pay taxes because they’re scared of the consequences. So, you don’t file one year, and then… nothing that terrible happens! So you’re off to the races. And then you get a scary piece of mail from the IRS, and you ignore it, and… nothing terrible happens again! It’s very easy for the human mind to acclimate to this.

And then, they will make it so that you can’t ignore them. (For instance, your debit card will stop working! Heh.) You should head that off at the pass. The moral being: even if you aren’t scared of the consequences now, you will be later.

Ugh, they sent a letter to everyone I’ve ever worked for! How humiliating!

Nah, it’s not. Years ago, the IRS sent out a letter to people who’d paid me money, informing them they had an interest in having that money for themselves. And half the people who got these letters — caring, decent, professional, adult-type people! — were like “Ha, I got one of these letters last year!” It was a moment of bonding. To be fair, one person was a little judgmental, but you are by no means alone in these issues.

So how do I work out paying if I haven’t paid?

You know how GE and Bank of America don’t pay any taxes? That happens because they’re well-advised. You too should be well-advised. Down the road, if you end up in debt with the IRS, you will likely have a couple of options — usually Offer in Compromise or Payment Plan. These are actually not terribly straightforward. For instance, you can work out a payment plan with the IRS, after filling out quite a lot of paperwork, and having your financial life pretty well-surveilled by them, but the IRS is actually required to ensure that you have enough money and income to meet the payment plan. (They can’t agree to a payment plan that’s onerous.) But that doesn’t mean that, even if you are on an installment plan, that penalties don’t continue to accrue! So, many people find that they’re often better off getting a bank loan. And Offer in Compromise is extremely complicated. With those, for instance, you cannot miss a yearly tax payment for at least the next five years, or the deal is off. So you are going to need to become an expert — but more importantly, you’re also going to need to consult with a real expert.

Ugh, I don’t know what to do!

Guess what? The IRS only wants to hear from you. Also? These things are never as bad as you think. Now go off to your quiet place and do your taxes. I can promise you’ll be happy you did.

HELP I’M PANICKING!

Lots of online tax products are free to use to file an extension. If you can’t do ANYTHING else at all, do that.

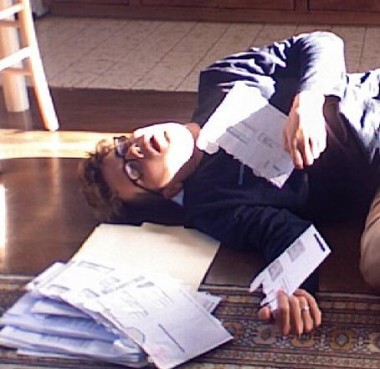

Photo by the one and only Mat Honan.