Cuddlecore NMH Cover

Here is a voice-and-ukulele version of Neutral Milk Hotel’s In the Aeroplane Over the Sea. You will either be horrified or delighted, depending. [Via]

Heroin In Britain Now More Anthraxy

If you’re planning to spike up on Knifecrime Island, take care: Apparently the smack there has been cut with anthrax-infested bone meal.

Understanding the Commercial Real Estate Crisis

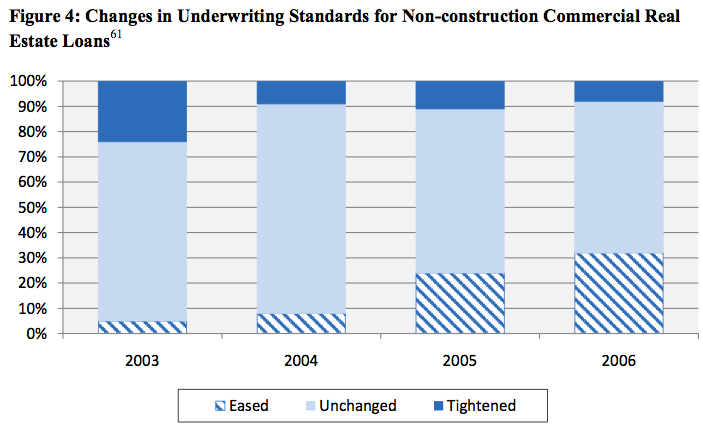

Earlier, we mentioned today’s Congressional Oversight Panel’s report on what they call “a commercial real estate crisis on the horizon.” The horizon, it turns out, is rather near! So, let’s back this up. Commercial real estate loans usually have a rather short term of between three and ten years, and there is often a large final payment at the end of that term-a payment which is almost always covered by an additional loan. The panel is explaining, rather obviously, both that loan default rates are already high and that additional lending is difficult to secure, and so a rather high rate of default on these much larger payments should certainly be expected. Over the next four years, $1.4 trillion in loans will hit the end of their terms. Half of those loans are for property that is underwater. What’s more, a number of these loans come from banks that may be stretched a bit thin. Those are the basics, but let us look at some of the panel’s easy to understand graphs about the situation!

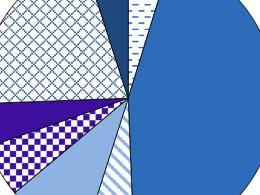

Because large institutions aggressively took over residential lending, smaller banks began to focus on commercial lending. But big banks still took the big customers, obviously, who could show easy income from other properties to secure loans. So, in short, the small banks were left with the riskier offerings. This graph categorizes loans made with what are politely called “lax” standards.

Meanwhile, the nature of commercial lending was changing. “In the late 1990s, only six to nine percent of the loans in commercial mortgage-backed securities [CMBS] transactions were interest-only loans, during the term of which the borrower was not responsible for paying down principal. By 2005, that figure had climbed to 48 percent, and by 2006, it was 59 percent.” Translation: three out of five of the CMBS loans in 2006 were not even engaged in paying down the loan; they were merely servicing the interest, a much smaller payment. Just ten years ago, nine out of ten CMBS commercial loans were actually having the money owed paid down.

The number of interest-only loans ratched down dramatically in 2008, but had a significant upswing in 2009.

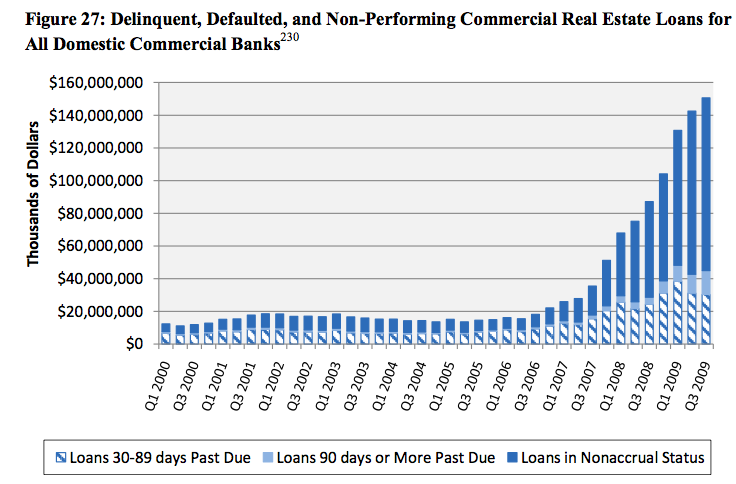

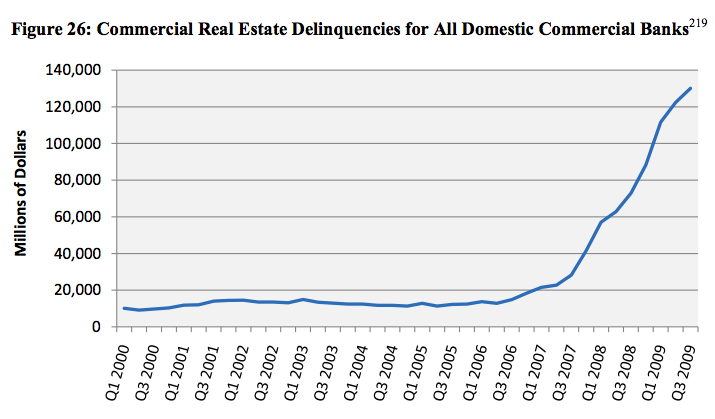

“Nonaccrual status” means a loan that is no longer collecting interest, most likely because it is beyond 90 days overdue. This graph pretty much speaks for itself!

I would suggest that this graph speaks for itself fairly well also.

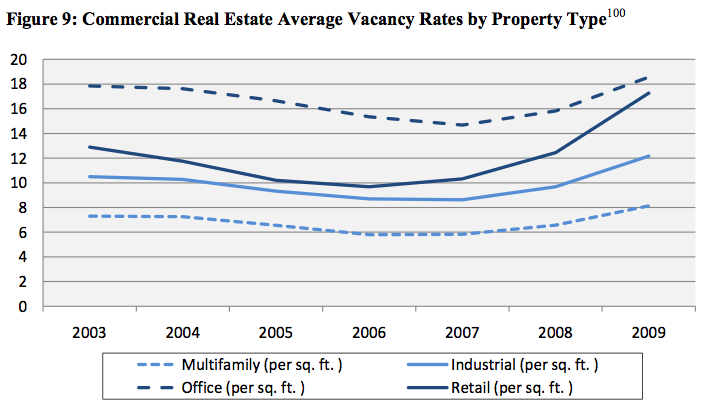

This graph explains some of the underpinning of loan default due to that old tradition of nonpayment, called “lack of income due to vacancy.” Of particular note is the strong recent upswing in retail vacancy.

Those are some of the basics. The entire report is largely readable by real humans, if you’d like to give it a whirl! (And don’t be scared of its 189 page length-there’s just a lot of footnotes and appendices and stuff. You know, facts and whatnot.)

Oh Ooh Oh, Oh Your City Lies In Dust

“Dirty flags advertise rock-bottom discounts on empty starter mansions. On the ground, foreclosure signs are tagged with gang graffiti. Empty lots are untended, cratered with mud puddles from the winter storms that have hammered California’s San Joaquin Valley.” That’s the Times’ Timothy Egan reporting from the town of Lathrop, where median home prices have fallen from $500,000 to $150,000.

The ruins of past civilizations come to mind, like Pompeii or something from the Amazon. You wonder whether in fifty years, places like this will be reclaimed by nature, vines hanging through skylights into McMansion grand rooms. (Probably not, Egan argues, as America’s human population continues to boom. Did you know that since 1970, the country has added more people than live in France? Crazy.)

Similar thoughts seem to be on the minds of artists and architects these days, as evidenced by a slide show at Fast Company that collects images of the “dream interventions” proposed by some of the folks the Guggenheim Museum asked to design installations for its central atrium in celebration of its 50th anniversary. Three of the eight pictures depict Frank Lloyd Wright’s pristine white masterpiece crumbling and/or overgrown with vegetation. Here’s the entry from Denmark collective N55:

It also puts me in mind of a passage from John Cheever’s 1961 Some People, Places And Things That Will Not Appear In My Next Novel that has really being giving me comfort lately as I consider the question of whether, or maybe just how fast, American society is collapsing. (Leave it Cheever-so famous for seeing the world through rose-tinted glasses-to cheer you up, right?)

3. All scornful descriptions of American landscapes with ruined tenements, automobile dumps, polluted rivers, jerry-built ranch houses, abandoned miniature golf links, cinder deserts, ugly hoardings, unsightly oil derricks, diseased elm trees, eroded farmlands, gaudy and fanciful gas stations, unclean motels, candlelit tea rooms, and streams paved with beer cans, for these are not, as they might seem to be, the ruins of our civilization, but are the temporary encampments and outposts of the civilization that we-you and I-shall build.

And here’s the video for Siouxsie and the Banshees’ 1985 single, “Cities In Dust.”

Dress Your Doody In Cashmere And Lace

Now you can wipe your ass on cashmere!

I mean, some of you may already be wiping your asses on cashmere, but now it is available in toilet paper form! This is so much better than farting through silk.

Inevitable "Toy Story 3: Return Of The Living Toys Again" Trailer

You know what? You’re probably going to see this somewhere today, so you may as well see it here. I know, I know, it’s a children’s movie, blah blah blah, but whatever; excepting Cars, I have never seen a Pixar movie that has disappointed, and this one looks amazing, visually-speaking. Enjoy. Or go watch the cat videos again, I don’t care.

Cat Blizzard Videos Made By People Who Should Have Cats Taken Away

https://www.youtube.com/watch?v=WeyXgPbbYmU

You know what happens when it snows a whole bunch and people have cats? Yes. They throw them in the snow. A trawl of YouTube helps us identify the people we should locate and go to their houses and forcibly remove their cats, who are all being thrown in the snow because, I dunno, there were no children to lock in the basement or whatever. Update: Interesting! Some people are already removing their cat-tossing videos that were posted here.

https://www.youtube.com/watch?v=VUMBv9lysFA

https://www.youtube.com/watch?v=0tK2LXTEnds

https://www.youtube.com/watch?v=zvYdBWG5zTg

https://www.youtube.com/watch?v=VvxVzkx1ly0

And for the win, these cats are all, screw you, I love it out here, I’m staying.

https://www.youtube.com/watch?v=P1iNBInFHUQ

https://www.youtube.com/watch?v=GuI0Ce6dylg

Previously In The Awl’s Series Of Cat Video Reportage: World’s Best Cat Video Is Most Likely Also Metaphor For Your Day

Up Next: More Trouble

Nothin’ but good times ahead: “A huge wave of mortgage failures on commercial real estate could hit next year, causing banks to lose as much as $300 billion, imperiling lending for small businesses and hindering the economic recovery, a Congressional panel is warning.”

Ana Marie Cox Employed (Again!)

Ana Marie Cox, unemployed since the shut-down of Air America, is now the Washington Correspondent for GQ.