When Will OpenTable Crash?

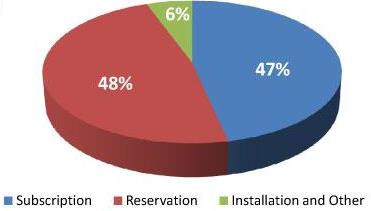

As a casual OpenTable user, I’ve always had the client-side operations of the service hidden from me. Because for users, it’s such a win: I can survey 40 restaurants and decide when and where to eat? Yes, please! So it’s good to know about the costs on the restaurant side, explained in this letter from a restaurant-owner that’s making the rounds. (And on the business side, yeah, wow is that stock overvalued.)

Plight of the Concords

American culture is full of stories of the underdog triumphant. It is one of our most fundamental and beloved visions, with roots deep in our national soil thanks to our struggle for independence from England and our Judeo-Christian traditions. The underdog is also a powerful element of the mystique of the American Dream — the idea John Q. Everyman can humble the powers that be with grit, ingenuity and a little (or a lot of) luck. It’s a mythology as pervasive as apple pie, Ayn Rand and the country’s first black president. And it is perhaps most visible each spring in college basketball’s annual season-ending extravaganza, the NCAA tournament.

Never mind that, on the court, Goliath almost always prevails in the end. No school from outside the big six, or BCS, conferences (Big East, ACC, SEC, Big Ten, PAC 10 and Big 12) has actually hoisted a national championship trophy since the anomalous, NBA-talented UNLV squad of 1990, a full 20 years ago. But enough little guys have their giant-killer moment in earlier rounds to propagate this attractive and lucrative idea (most recently Butler’s run to the NCAA finals last spring).

In truth, the aura surrounding March miracles is a huge reason the game’s popularity has never waned despite various member schools’ scandals, ebbs and flows among elite talent, defection to the professional ranks and the subsequent effects of parity. Tuning in to watch the school that shouldn’t be there make it through is (along with pervasive illegal betting pools) what makes the first two rounds of the tournament the best live sporting event on the planet. There are no round robin pools, no weed-them-out home-and-away aggregate series, no second chances. If you don’t show up to play that day, you may be gone. And if you’re a nobody, and you do show up to play, legend awaits. It’s the American Dream writ large, and streamed into homes nationwide.

But as beloved as the NCAA tournament’s anything-can-happen vibe may be in March, it’s a much different scenario in the season’s opening weeks. In the dog days of November, the Cinderella story more often takes a substantially darker, if more realistic, turn.

November basketball is generally a pretty ragged affair. With the advent of ever-stricter rules for coaches’ access to players, an ever-increasing attrition rate among big program rosters and, some argue, a significant deterioration of fundamental skills among elite prep basketball talents, schools in the power conferences need more time than ever to work out their kinks. Usually this means much more time than an abbreviated early-season schedule allows for.

To help speed up this maturation process, big schools pony up six-figure paydays to smaller ones from off-the-radar conferences to line up as sacrificial lambs for a night, either in exhibition games or in actual on-the-schedule ones. And smaller schools jockey for the opportunity. But why? Why put yourself on the line for that kind of humiliation?

Simple economics. Say you are the coach or athletic director at Charles Dickens U, a small school in a corner of a state that time and ESPN forgot. You play a schedule entirely devoid of televised games, are not expected to make any postseason tournaments and yet still have a roster of players to feed and clothe and a season’s worth of travel to account for. And, despite it all, you still harbor hopes of rising above your current piddling station in hoops life. A game or two getting your ass handed to you at Cameron Indoor Stadium or Rupp Arena can not only provide your team with the invaluable experience of playing against superior talent and and provide much-needed exposure for future recruiting pitches, it can literally make your program’s budget for the rest of the season. All for the low, low cost of getting waxed in a game no one but your players will ever remember you even playing. Setting it up this way, it doesn’t sound quite so humiliating after all. It sounds, well, totally understandable.

So they do line up: the Libertys and the McNeese States and the North Floridas. If your school’s name prominently features a direction or takes its name from a dead rich guy or religious zealot, you’re already aware of this.

But it’s not all about economics. Certainly, coaches at the non-power programs see value in performing on a grander stage. That one game may offer your players a chance to play a regionally or even nationally televised game. For some talented players off the major college basketball grid, one fine showing against a big-name school, even in a loss, can mean a potential pro future. The same goes for the coach. Small schools are the breeding ground for future big-college coaches, and making a splash in an early season tune-up game can bring exposure in a way no amount of press releases from the A.D.’s office can.

Of course, the opportunity for humiliation does still exist, just not in the way one might expect. No one really begrudges Charles Dickens U for getting its clock cleaned in a play-for-pay game in November. After all, that’s what was supposed to happen. Conversely, there is really only one thing you are absolutely, positively not allowed to do if you are a power conference school in the opening weeks of the season, and that’s lose one of these November tune-up games.

Just ask Wake Forest, who clanked the rims to the tune of a 10-point loss to Stetson in their home opener on Friday. Even worse for Wake, this was the Demon Deacon debut of former Colorado and NBA coach Jeff Bzdelik, whom the school hired to replace Dino Gaudio (let go despite the fact that he led his team to the second round of the NCAA tournament last March). Ouch. Ditto the result for new Iowa coach Fran McCaffrey in a loss to South Dakota State. In fact, if your coach is brand new, you might just want to steer clear of the nobody school, can’t-lose game altogether.

The quintessential example of this phenomenon came three seasons ago when blueblood Kentucky — ranked 22nd in the country and featuring much-hyped new boss Billy Gillispie — hosted also-ran North Carolina school Gardner-Webb in a second round game of the 2007 2K Sports College Hoops Classic. Kentucky’s undergraduate enrollment is roughly 30,000. Gardner-Webb’s? 4,000. Kentucky has won seven NCAA titles. Gardner-Webb has yet to reach an NCAA tournament.

The teams were only playing because they were paired by the organizers of the 2K Sports College Hoops Classic, one of a slew of early season made-for-television sham tournaments where hand-picked power schools host (supposed) patsies, then advance to play real games against other hand-picked power schools, all for television money. The plan was for the winners of the regional rounds to advance to hallowed Madison Square Garden for the semifinal matchups. After Gardner-Webb scored the game’s first 14 points and humiliated the Wildcats 84–68 on their home floor, sending the Bulldogs on to play Memphis in a half-filled MSG a week later, pretend tournaments everywhere panicked, deciding they would no longer take the chance of such an unpredictable outcome. Now marquee schools in these events “advance” to the nationally televised rounds automatically, results be damned. So much for tradition.

Then again, it’s always been this way for underdogs to some degree. The Romans may have accepted a lion chomping a few guys, but eventually the gladiator has to win. No one pays to see the bull gore the matador. OK, well, a few do, but it’s not the way it’s allowed to happen long-term. Even here, in America, where the underdog strand is woven so deeply through our cultural history, stories of the little guy emerging triumphant are memorable precisely because they are so rare. NCAA basketball is no different.

Anyway, America’s underdog story is never quite as simple as it seems. The schlep in the mailroom doesn’t just work his way up the corporate ladder with guts. He’s a conniving, scheming bastard, too. And America’s Revolutionary War patriots who braved those staggering odds to best the world’s foremost military power were essentially guerillas, eschewing their era’s ethical rules for war because (a) they were idiotic and (b) they didn’t stand a chance otherwise. Does this make these stories any less heroic or memorable? I guess that depends on how caught up on ethics you are. For some folks, it’s known as pluck. For others, it’s considered being a cheating asshole.

But even potential cheating assholes need new Nikes to play in, and that’s why Concord University of Athens, West Virginia, happily made the trek across the state to get pasted 112–65 by Marshall in an exhibition game a few weeks back. And it’s why Concord will be happy to do it again next year. For a tidy fee, of course.

Originally from Kentucky, JL Weill now writes from Washington, DC. His take on politics, culture and sports can be found at The New Deterrence and on Twitter.

Facebook, Apple, To CHANGE EVERYTHING in Next 24 Hours

The stress! Facebook Email is allegedly rolling out at 1 p.m.? And tomorrow Apple is going to CHANGE EVERYTHING with some mysterious iTunes announcement? Man, I was so happy when email came out but now everything’s so complicated, so unendingly, exhaustingly game-changing. I’m not sure I even know what the game that’s being changed is anymore!

When They Say "Everyone" Must Sacrifice, They Mean Poor People

There is no spectacle quite so stirring as the pundit swaggering to the bar of public opinion to deliver a good and shrill scolding. So let us tend to the chastisements of Washington Post columnist David Broder — recently heard hailing an invasion of Iran as an economic stimulus measure — as he now urges the stiff medicine of the Bowles-Simpson deficit-reduction plan on a feckless American public. Broder is, after all, the dean of American political journalists (though I’ve always found this locution puzzling, since so few political journalists actually seem to graduate — and perhaps more to the point, when was the last time anyone reported an actual dean saying anything remotely relevant to anything outside his or her own chosen bureaucratic warren?) But let such caviling pass: Deans are also in the business of study-body discipline, so let’s glumly don our letter jackets and shuffle over to his office waiting-room for our paddling.

For you see, in Broderland, the noble co-chairs of the president’s debt commission, Erskine Bowles (he of the six-figure Morgan Stanley board salary) and Alan Simpson (he of the decades-long crusade to decimate Social Security) are administering “the equivalent of a cold shower after a night of heavy drinking.”

Never mind that, in structural terms, there’s no evidence that the sizable $1.4 trillion federal deficit represents anything all that intoxicating — indeed, it is much more in the nature of a desperate defibrillator session than a giddy bender. Our present deficit — which is already shrinking, by the way — largely represents necessary efforts to spark consumer demand amid a world-historic economic slump. And far from incidentally, it also reflects the legacy of the longer-term fiscal chicanery of the Bush years, which kept two major tax cuts, two wars and an enormous expansion in Medicare benefits largely off the books.

Never mind as well that the rhetoric of deficit hawks — almost always conceived as a respectable draping for the usual D.C. entitlement brigandry — translates, amid present conditions of contracting demand, into disastrous economy policy. “Our biggest problem isn’t the size of pending federal budget deficits or debt but an anemic recovery that may drag on for years,” writes former Clinton Labor Secretary Robert Reich. “If Congress and the president started right now to cut the federal deficit — slashing spending and raising taxes on the middle class — our anemic economy would quickly become comatose.”

No, our dean won’t be detained by such mere empirical concerns. Math is hard — and more to the point, the resolve of discipline-minded public servants is so inspiring!

After all, he interviewed the sage public servants Bowles and Simpson in Boston this summer, “and they made very plain that they were going to lay out what it would take to solve this problem, in all its gory detail.” And Broder can scarcely conceal his own stoic glee in reporting their verdict: “Everyone and every institution will have to contribute — no, genuinely, sacrifice — if we are to repair the damage to our economic health. No area of government spending will be spared…. The tax system will change and collect more from the people than it does now.” And the upshot of all this exhilarating sobriety? Why, more bipartisanship — the hooch that sends the David Broders of the world into their own besotted deliria, for years on end:

No Democrat can believe, looking around, that he or she can protect all the programs passed since the New Deal and Great Society days. Not with all those Republicans and Tea Partyers sitting there with their knives out. And no Republicans, no matter how ideologically isolated, can believe that the Democrats whose votes will be needed for any package will permit all the sacrifices to be made only on the spending side — especially in the low-income programs.

Well, no, actually. The Simpson-Bowles package of proposals tilts almost unilaterally to the right — not exactly a shock, given the high concentration of deficit commission staff who are also drawing salaries from the father of all entitlement hysterics, Peter G. Peterson. (Broder could have stumbled upon this illuminating conflict of interests if he’d bothered to consult the coverage by his own Post colleague Dan Eggen.) As Reich and others point out, the draft commission plan says virtually nothing about what’s driving the bulk of government spending into the red: the explosion of private-sector health-care costs. “More than half of health-care costs are paid by the government,” economist Dean Baker notes, “hence the public-budgetary impact of our private system…. Simpson and Bowles’s report seeks saving in public-sector health programs, primarily by making patients pay more for care. But there is no discussion of the private health-care system that is the root of the problem.”

Which is not to say the document is silent on health care per se — as a far more intellectually honest columnist, the L.A. Times’ Michael Hiltzik, observes, Bowles and Simpson champion one brazenly ideological sop to the right as a putative cut in health care costs: a proposal to “impose tort reform to ‘pay lawyers less and reduce the cost of defensive medicine’” — defensive medicine being the GOP buzzphrase for “plaintiffs attorneys fees,” since trial lawyers are major Democratic party donors. And how much does “defensive medicine” contribute to the actual spike in health care costs? As Hiltzik explains, “According to CBO testimony in 2008, zero percent. That’s right, zero.”

Nor, as Baker points out, is there any effort in the commission’s preliminary report to bring our dubiously productive financial system under any remote measure of fiscal discipline, despite its outsized role in stoking the housing market’s $8 trillion collapse.

Simpson and Bowles apparently never considered a Wall Street financial-speculation tax. This is an obvious source of revenue that even the International Monetary Fund is now advocating in recognition of the enormous amount of waste and rents in the financial sector. It is possible to raise large amounts of revenue from such a tax.

University of Massachusetts economist Robert Pollin and I calculated the potential revenue at more than $100 billion a year, with little impact on productive economic activity. The main impact would be to reduce the shuffling of financial assets.

Instead, the pain here unduly falls on low-to-middle-earning Americans, as is always the case when deficit hawks try to impress each other with their manly command of cold, hard fiscal truth. As Baker explains, Simpson and Bowles achieve the bulk of their proposed spending cuts by…

raising the retirement age, cutting benefits for middle- and higher-income workers, and reducing the annual cost-of-living adjustment so that retirees would no longer see their benefits rise in step with the consumer price index. Raising the retirement age seems more than a bit unfair, since most of the gains in life expectancy have been going to workers in the top half of the income distribution. Workers in the bottom half have seen minimal gains in life expectancy over the last three decades.

The cuts in the benefit formula will hit anyone who has average wage earnings over their lifetime of more than $36,000. This is not most people’s definition of affluent.

All of which gives a rather prodigious lie to Broder’s pundit-fairy tale about “everyone” being sternly summoned by Messrs Bowles and Simpson “to contribute — no, genuinely sacrifice” in the cause of choking off government spending at the very moment when it desperately needs to expand. And really, all macroeconomic considerations aside, there’d be one incalculable benefit of preserving the present retirement age, and enforcing it more aggressively in the private sector: David Broder would have been handed his gold watch, and started collecting his dean’s pension, 16 years ago.

Chris Lehmann will be quizzing you on the membership of the National Commission on Fiscal Responsibility and Reform later.

Science Vs. Math, It's So On!

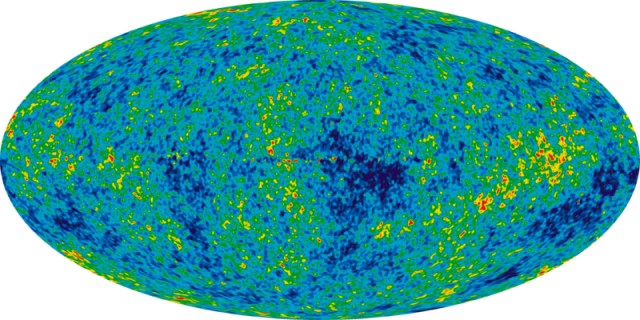

“I think this is funny because it explains a problem I’ve had with math all along, which is that math just makes stuff up: makes up numbers, and space between numbers, and relations between numbers, and I’m not even mentioning zero. Also I know that the horizon problem went something like, the universe shouldn’t have been born as uniform as it was because it was farther across than light — which created the uniformity — could have traveled by then. Something like that. So AG’s mathematicians solve the problem by making light travel faster than light.”

— I’m with Awl pal Ann Finkbeiner: Math sucks! (Especially zero!) After that, she kind of loses me. And hurts my brain. But I’m pretty sure I like what she’s saying about this cartoon about the different methods of solving astronomy’s “Horizon Problem.”

The Weekly Beast: Doing the Math

The Daily Beast loses something like $200,000 a week. Newsweek loses around $500,000 a week. (Actually more like $538,000 — that’s $28 million a year.) Put the two entities together and you’re losing a million dollars every ten days or so. Sure, there’s some cash incoming — Newsweek has $165 million in annual revenue! Which is a ton of money… almost none of which comes from Newsweek.com. Making sense of the properties online is the most confusing order of the merger. (What will be done to the print product seems pretty obvious to most.) Particularly given that Newsweek.com has two to three times the traffic of the Beast. Here’s the case for not shutting down Newsweek.com, which includes “not throwing away $9 million a year,” because, you know, who doesn’t like $9 million a year? Why, that pays for like 90 days of burn rate! After all, Newsweek.com only loses $38,000. Each week. Seems like almost nothing in all those other numbers, right? In any event, now the firings begin.

[Relevant disclosures: I have taken money from the Daily Beast and enjoyed it. I like Tina Brown. I have never read an issue of Newsweek, not even at the dentist.]

James Blunt Saved The World Before He Destroyed It

“We had 200 Russians lined up pointing their weapons at us aggressively, which was… and you know we’d been told to reach the airfield and take a hold of it.”

— This is very weird. In 1999, British singer James Blunt “prevented World War III,” as the BBC puts it, by refusing Nato Supreme Commander Europe General Wesley Clark’s orders to attack a Russian battalion in the confusing war in Kosovo. Why would he do that, only to go on six years later to record and release “You’re Beautiful,” which surely did at least as much damage to humanity as full-scale war between nuclear powers would have?

Michael Wolfensohn Hates American Dream, Cupcakes

“When Andrew DeMarchis and Kevin Graff, two 13-year-olds from Chappaqua’s Seven Bridges Middle School, set up shop at Gedney Park on a fall weekend last month, they were expecting a tidy profit. Instead, the two wannabe entrepreneurs selling cupcakes, cookies, brownies and Rice Krispie treats baked by them for $1 apiece got a taste of cold, hard bureaucracy. New Castle Councilman Michael Wolfensohn came upon the sale and called the cops on the kids for operating without a license.”

— Local man trounces local Jewish children with a dream.

Rupert Murdoch Changes The Face Of Journalism Again

It’s both a celebration and an innovation: “To celebrate the 40th anniversary of the national insitution, we’re bringing it into the 21st century with our fab new interactive feature. Who’d have thought 40 years ago that you’d one day be able to interact your favourite Page 3 lovely. Simply click the link to launch a pop-up of today’s Page 3 girl Hollie, click and drag your mouse and watch as she turns…. she’ll pirouette to your command.” [WARNING: Includes tits.]

A Proposal for a Commodities Market for the Legal World

Who wants in on my new firm? Here’s how we’re going to do it. We’re going to open a simple trading market, right, which’ll easily get approved by the Commodity Futures Trading Commission, led as it is by Goldman Sachs alums. This will have a forward-facing straight-up predictive betting market on investment-backed lawsuits. (Later we’ll open up that market to straight-up gambling on all law cases, because, who wouldn’t want to go big on counterintuitive Supreme Court outcomes what with the new Justices?) Then we’ll package and roll-up the investments in class action and high-end litigation. We’ll let the lawyers openly re-sell their actual debts and costs in an exchange, so they can access up-front cash (with, of course, ballooning interest). It’ll encourage speedy settlement! It’ll clean up the courthouses! Then we can tranche the debt and reinsure it via some morons like AIG, who’ll be left with costs, that’ll then get paid by the Goldman Sachs alums in the government. Everyone wins!