Dick Joke

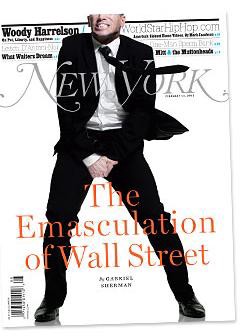

Oh dear, here we go again: “Wall Street is a meritocracy, for the most part,” an irate but of course unnamed onetime Citigroup executive confides to junior father confessor Gabriel Sherman in this week’s hallucinatory New York magazine cover story, “The Emasculation of Wall Street.” “If someone has a bonus, it’s because they’ve created value for their institution.”

In the jumpy, suggestible universe of Gabe Sherman, Wall Street sleuth, things really are that simple: The beleaguered financial overclass creates value, in a rationally ordered system of maximally awarded talent. And the clueless public sector, intoxicated on post-meltdown regulatory prerogative, meddles with the primal forces of nature, skews executive compensation downward, panders to the blurry “populist” agenda of the Occupy Wall Street Crowd, generally foments market uncertainty and other forms of intolerable chaos so that presto, before you know it, we have “The End of Wall Street As They Knew It.”

In other words: To your crying towels, bankers! Correspondent Sherman is on the scene, and no howling distortion of recent financial history you care to offer is too outlandish for him to faithfully record! After duly huddling with a couple of dozen financial titans, our reporter has arrived at a chilling verdict: “what emerged is a picture of an industry afflicted by a crisis it would not be flip to call existential.”

Perhaps not — but what is exceedingly flip is brother Sherman’s account of the origins of the crisis.

Sure, there was that awkward business that sent the global finance sector to the brink of ruin, plus a devastating tsunami in Japan and whatnot — but the true culprit sending Wall Street titans back into their bedrooms to listen to Interpol on auto-repeat and cut themselves is of course the specter of government regulation. The Dodd-Frank financial reform act, a largely toothless measure lousy with loopholes and lobbying dosh, becomes in the alternate universe of Adam Moss’s New York magazine a rash bid to expropriate the expropriators. Even though the full provisions of the already anemic bill don’t go into effect until 2016, the very thought of a somewhat straitened financial playing field so terrifies Wall Street’s stout corridor of wealth creators that, well, they’re bidding farewell to the most valuable commodity of all — their big swinging dicks. “The government has strangled the financial system,” Dick Bove, an especially excitable and frequently mistaken bank analyst, tells Sherman. “We’ve basically castrated these companies. They can’t borrow as much as they used to borrow.”

You see, by force of the Volcker rule — a watered-down version of the central Glass-Steagall protections separating out commercial and investment banking that were disastrously repealed in 1999 — Wall Street is re-thinking everything, from the scale of its year-end bonuses to its “core value to the economy.” And Bove, for one, preaches that all this doom-and-gloom thinking can’t help but be self-fulfilling: “These are sweeping secular changes taking place that won’t just impact the guys who won’t get their bonuses this year. We’ve made a decision as a nation to shrink the growth of the financial system under the theory that it won’t impact the growth of the nation’s economy.” Another unnamed informant tells Sherman that the financial industry is gearing up for a state of near permanent pay-austerity at the mere thought of the Volcker rule, which doesn’t kick in officially until July: “If you landed on Earth from Mars and looked at the banks, you’d see that these are institutions that need to build up capital and they’re becoming lower-margin businesses. So that means it will be hard, nearly impossible, to sustain their size and compensation structure.”

Never mind that this diagnosis is diametrically opposed to the Bove-ian school of market alarmism, which holds that banks are being starved of desperately needed leverage and credit; this unnamed fearmonger sees them in a frenzy to raise capital, and one thing the Volcker rule undeniably seeks to achieve is minimal capital requirements to prevent speculative lending from veering once more into toxic chaos.

No, for Sherman, all that’s needed to stoke the proper mood of Misean panic is to rouse the specter of frightened bankers, and a few quick-and-dirty quarterly profit reports.

From the moment Dodd-Frank passed, the banks’ financial results have tended to slide downward, in significant part because of measures taken in anticipation of its future effect. Since July 2010, Bank of America nosed down 42 percent, Morgan Stanley fell 25 percent, Goldman fell 21 percent, and Citigroup fell 16 — in a period when the Dow rose 25 percent.

Other economic journalists might conclude that this downturn was a set of long-overdue market corrections, and given the broader turn around in the actual manufacturing economy, by no means an indication of worsening conditions — for investors and workers alike. Some radical others might even suggest that the shredded headcounts at the financial firms played a part in their own downturn in revenue. But while from his evidently privileged vantage in the driver’s seat of the Doc’s Time Machine, Sherman can divine all sorts of mischief arising from the yet-to-be-implemented provisions of Dodd-Frank, it does bear reminding that since 2010, BofA has been forced to eat a sizable portion of the toxic mortgage debt it acquired amid its spectacularly ill-advised purchase of Countrywide; Morgan has suffered tremendous losses in its Japanese operations and has, like most banks, been spooked by its exposure to the Euro-debt crisis (funnily enough, the firm’s US-based investment-banking operations — ie, the shop most directly affected by the dread Volcker rule, has booked profits amid all the tumult abroad); much the same general picture holds at Goldman, which as you may recall, has had more than its share of legal contretemps thrown into the bargain . As for Citigroup — the company whose very grotesque merged existence was the deregulatory excuse for repealing Glass Steagall — it’s been a basket case for so very long that a 16 percent loss in profits over the past two years seems cause for celebration, Volcker Rule or no Volcker Rule.

Indeed, for all of Sherman’s gullible huffing and puffing over the destructive reach of our new financial regulatory state, no one seems to have told the nation’s financial system this dire news, to judge by the actual behavior (as opposed to the opportunistic media rhetoric of its leaders). Yes, it’s been a rocky couple of years. And sure, Wall Street has lately shed plenty of jobs — who hasn’t? But in a report to investors inconveniently released one day ahead of Sherman’s dispatch from the existential trenches, Goldman Sachs — which continues to enjoy bullish stock performance amid its profit setbacks — announced this bit of non-emasculating news:

From a financial markets perspective, the environment looks quite friendly. The combination of better growth news and easier monetary policy is always welcome. In addition, we recently argued that corporate profit margins may still have room for further gains, despite the fact that they already stand at record levels from both a bottom-up and top-down perspective.

But no such merely empirical considerations can hope to stand up against the wrath of a stable of mainly unnamed bankers! Why, just look at Goldman itself, where Sherman reports that “months before the Volcker rule is set to kick in, star traders began [sic] to leave in droves.” And Goldman has lately shuttered its proprietary hedge-fund shop — in recognition that the line of essentially free credit that the Fed has opened up to investment houses may at last be about to dry up.

This, too, might well be seen as a sign of comparative health in the broader economy — especially with Goldman itself sounding so bullish on the investment climate, with the dread implementation of the Volcker Rule a scant five months away. After all, easy credit is what creates unsustainable bubbles in the first place, as even the most cursory study of the 2008 debacle shows. But not so in Shermanland! Even breakaway hedge shops are booking fairly lackluster profits (despite the obscene tax advantages they continue to enjoy) — so you know: Panic, everybody! Only Sherman is even less clear in explicating just what the cause for alarm is supposed to be in this case — while banks’ hedge-fund divisions are curtailed under the Volcker rule, hedge funds themselves need not tremble before its pending implementation. There’s the bad economy, yes — but it’s just as important, he insists, to note that the hedge sector is “as overbuilt as the housing and credit markets that drove its profits,” with the overall number of hedge funds exploding about 16-fold (610 to 9.553) from 1990 to 2011. One would assume that a slowdown in an oversupplied speculative sector is not, you know, a bad thing by itself, either — especially given that even the most diehard Randians would be hard-pressed to demonstrate that hedge funds create economic value of any kind. But Sherman nonetheless frets on behalf of hedge managers that “the easy obvious plays are oversubscribed, which shrinks margins…. Many have predicted a hedge-fund shakeout, and it seems to have started. Over 1,000 funds have closed in the last year and a half.” It’s evidently a taken-for-granted, second-nature kind of axiom in today’s American economy that an “industry” made up entirely of “easy obvious plays” is integral to our very survival.

Or at the very least, it’s a great enabling premise of lazy, overclass-osculating, dick-obsessed magazine journalism. Witness Sherman’s closing brief for the productive wonders worked by yon investment class:

It’s certainly true that Wall Street’s money played an important part in New York’s comeback, helping to transform the city from a symbol of urban decay into a gleaming leisure theme park. Consciously or not, as a city, New York made a bargain: It would tolerate the one percent’s excessive pay as long as the rising tax base funded the schools, subways, and parks for the 99 percent. “Without Wall Street, New York becomes Philadelphia” is how a friend of mine in finance explains it.

Well, Gabe, I have news for you and your friend in finance: For the vast majority of people living in the glorious and gleaming leisure theme park known as Michael Bloomberg’s New York, Philadelphia looks pretty goddamn inviting (and not just for delusional “sixth borough” hipsters). For one thing, the city’s schools have lately taken to looting state budget funds to make up for shortfalls; the city’s parks are already relying to a disproportionate degree on private donations to run themselves — except, of course, when the mayor wants to unleash city cops to displace and round up those irksome unproductive kids protesting wealth inequality. And do NOT get us started on the regressively funded, frequently inoperative subways, OK?

Then again, New York magazine is, God knows, a gleaming theme park all its own, and it’s perhaps best not to disturb the placid reveries of its well-appointed editorial brain trust. Yes, sustaining the enabling fictions of New York-style policy analysis does involve adducing sweeping assertions from the thinnest air: “The rising tide of the real-estate and credit markets lifted all boats,” Sherman burbles, apparently in reference to hedge funds, but a quick Google search for “Long Term Capital Management” will rapidly disabuse any civilian in the real economy of such a ludicrous notion. (And the ever-fallacious “rising tide” thesis is especially laughable when applied more broadly in today’s America.) Likewise, Sherman’s wind-up paragraph preposterously announces that “the strictures that are holding the banks back now are tighter than any since the thirties” — certainly news to any financial regulator of the mid-twentieth century, when off-shore mutual funds were heavily prosecuted and hedge funds were much more regulated (even without mandatory SEC registration); or to the economic policymakers of the Great Society era, who enforced corporate tax rates north of 40 percent, more than twice of today’s post-Dodd assessments. But why should we expect any other version of events from the hallowed precincts of Adam Moss’s TriBeCa wing of the great New York theme park? For as this week’s cover story plainly demonstrates, nothing can be considered real in this abject weekly’s pages unless it comes straight from the mouth of a banker.

Chris Lehmann is the co-editor of Bookforum and is the author of Rich People Things.

A Drynuary Diary: The Frothy Aftermath

A Drynuary Diary

The Frothy Aftermath

by Jolie Kerr and John Ore

John Ore: Oh, Jolie! I just had the strangest dream! And you were there and everyone here and…Kurt Loder?…And I remember that some of it wasn’t very nice… but most of it was beautiful. But just the same, all I kept saying to everybody was, I want to go home. And they sent me home.

Jolie Kerr: Well you know what they say — there’s no place like etc.! So hey, old friend, it feels like it’s been years. Where ya been? How ya been? (Oh God, my head hurts so badly.)

John: Oh, you know, the usual: celebrating my wife’s birthday with drinks at the Waldorf, celebrating the Giants’ Super Bowl victory with a growler of Barrier Imposter Pils. No big deal.

Fitting end to Our Little Ordeal. My Last Temptation Of Drynuary consisted of mixing drinks for my wife on the eve of her birthday. (She tapped out 24 hours before me, deservedly so, but still logged 31 days). Toughest job I ever loved: at one point, I spilled rye on my fingers, and instead of treating it like a dripping ice cream cone, I WASHED IT OFF IN THE SINK. I felt like I was handling nuclear material.

Jolie: I don’t even understand why you decided to go the extra day. OH WAIT. I bet it’s so that you can feel EXTRA smug when we tally things up. In which case, I’m going to tell you that you (and plenty of other people) took a terrible drubbing at the hands of some friends of mine who think it PATENTLY ABSURD that you all denied me my O’Doul’s but let me knock off of Drynuary on the 27th.

Of course I didn’t exactly ask your permission to duck out early, now did I? Because I’m not that concerned with being liked. Please. We should discuss reentry. How did you break the fast and how did you feel during and after?

John: Hey, I explicitly gave you a pass on Luger’s from the get-go. That, coupled with extending my Drynuary into overtime, allows me to win the oh-so-important Smug Battle. That’s all that matters to me in the minds of “your friends.”

But! We’re all back on a level playing field now. We walked over the coals together, did the Trust Fall, signed each others’ yearbooks. (I was voted Most Likely to Lord Things Over You).

I like that we both ended Drynuary by making it an occasion, rather than cracking open a beer and watching reruns of “House.” For you, it was a martini at Peter Luger’s. For me, it was a Brooklyn at Blue Hill for my wife’s birthday: I’d been fixated on having a rye whiskey drink to break the fast. Watching the bartender make it was like foreplay. OMFG, it was the most delicious thing ever. I swear, after two sips I was concerned that I’d done irreparable damage to my tolerance, and would be curled up under the table by the time the appetizers were cleared. A couple of glasses of wine later (not to mention hitting two more bars after dinner!), I found my groove. No hangover on Saturday morning either! It’s a Drynuary Miracle!

So take us through that first martini at Luger’s.

Jolie: Actually, I broke with a glass of pinot grigio. I know! So unlike me. But our timing got a little thrown off and we ended up meeting for cocktails before Luger’s so I went for the grape juice and let me tell you, I was sucking it down like my life depended on it. Nothing has ever tasted so good. It was, quite frankly, embarrassing. I could hear myself slurping and my glass was noticeably draining faster than those of my companions. One of whom was my mother.

And then. Then! That Luger’s martini, oh man, it was so good. Just delicious and purely alcoholic and salty and alahsflkahdlkhsdg as our Higher Power would say. I sipped it, thank God, and then had one more glass of wine with dinner before heading home. Of course, once we got home we proceeded to DRINK ALL THE WINE AND SMOKE ALL THE CIGARETTES and oh ouch did I ever hurt the next day. As punishment I washed the floors at 8 a.m.

John: Yeah, I got a little cocky after Friday night. My tolerance hasn’t kept up with my appetite, and 7 a.m. Sunday morning wakeups were easier in Drynuary. The weekend was full of occasions to celebrate, but I’m looking forward to dialing it back during the week. Part of my promise to bring a little bit of Drynuary with me through the year. I’m sure that will last past, say, tonight!

Jolie: Speaking of keeping Drynuary with us, I do have some sad news to report: the return to the drink has not particularly agreed with me. I’ve had some jitters and some anxiety and have found that even one drink can mean I’m in for a world of hurt the next day. So I need to watch it, like, seriously. Which is the worst thing ever and I blame you entirely. WHAT DID YOU DO TO ME??

John: I think there’s a bug going around. It’s called Getting Older.

Jolie: I’ll buy that for a dollar. Shall we leaderboard?

John: LOL, “leaderboard”!

Jolie: More like “loserboard”.

Week Five, Post-Drynuary

Alcohol Consumed (units) Since End Of Drynuary

Jolie: 1 vodka martini extra extra dirty, 1 manhattan with extra extra cherries, 2 bourbons on the rocks, 2 coffees with bourbon, 4 mimosas, 14 Blue Moons, ALL THE WINE

John: 17

Days Without Booze During Drynuary

Jolie: 26 (January 1–27)

John: 32 (January 2-February 3)

Disposition

Jolie: A little a’fuss

John: Relieved

Irritability (scale of 0–10)

Jolie: 4

John: 2

Outlook

Jolie: Oh dear.

John: Moderating moderation.

Shakes

Jolie: A little bit maybe?

John: Not stirred.

Smugness (scale of 0–10)

Jolie: 0, I’ve been lying in a heap since falling off the wagon, not much here to feel smug about

John: 1, until my tolerance comes back, gonna have to ride my 32-day-smugness until it runs dry

Sounder Sleeping

Jolie: I woke up in the middle of the night and announced that “the f@

"The only thing ive.got to say is I didnt do it"

by Regina Small

Arguing with the local sheriff’s office on Facebook over your imminent arrest seems obviously unwise. But, setting aside immediate judgments, maybe having a very public and mostly neutral exchange with police wherein you affirm your innocence is…not the worst thing, actually? Accusations of coerced confessions and police strongarm tactics (as well as actual instances of coerced confessions and strongarm tactics) might be reduced by some transparency in the arrest and interrogation process, one hopes. Even if it makes everyone else uncomfortable. (And really, the comfort level of “bystanders” reading that exchange (“omg awkward”) should be so far down on the priority list if you’ve been accused of a crime.)

Remembering "The Day Today"

This interview with David Schneider of Chris Morris and Armando Iannucci’s brilliant “The Day Today” is worth reading in its own right, but is even better because it has some terrific clips from what is one of the greatest shows of all time. Do click over. [Via]

Is Madonna Eating Our Young? A Post-Halftime Discussion

by Julie Klausner and Natasha Vargas-Cooper

Natasha: Okay, what did you think of Techno Roman Madonna and her 13th legion last night?

Julie: Well, to me, Madonna is like the Catholic Church or Penn State. I’ll defend anything she does, even when she’s guilty. I’m loyal to the institution.

Natasha: What did you think of her football fruits?

Julie: I thought they were great.

Natasha: DON’T LIE!!

Julie: I thought she should have worn different shoes.

Natasha: This is like when the Catholic Church or Penn State blamed a sex abuse scandal on a couple bad apples!

Julie: The medley was tight, the concepts were good, it looked great and I’d say she sounded great if there was any evidence of her singing live. I like her new song.

Natasha: JULIE YOU DO NOT BELIEVE THAT!

Julie: I do.

Natasha: Do I need to provide fossil evidence?

Julie: What is your fossil fuel?

Natasha: WELL. I, too defend Madge against the haters. On message boards, in chat rooms, pool halls and in my prayers. She is an icon and nothing that she can do, ever, will diminish her. And I respect that she didn’t burn out into some awful tragedy so as to be forever embalmed in youthful glamor.

Julie: Youthful is the operative term.

Natasha: Like I’m sure if Marilyn lived it would have been GRISLY. But… but… The new song, the pleather gestapo boots, the weird annexation of other lady singers? I am underwhelmed! I think we deserve better! Also, girl, that video was an abooooorsssh.

Julie: You didn’t like it when she shot those football players with a gun? After coming out in a trenchcoat, COLUMBINE STYLE?

Natasha: I always support the promiscuous blending of vodka ads and columbine imagery! BUT the video looked cheap and slap-dashed, and tonight’s show felt soulless. Like, she turned on the jumbo jet of her fame but not her SOulLlLl

Julie: I’m worried about her youth obsession.

Natasha: Continue. Cuz this is my main complaint with her.

Julie: Well, her insistence on maintaining an exhaustingly current entourage, instead of changing/evolving/ageing, she just switches up the collaborators so they’re current. That’s depressing.

Natasha: I think she’s out-grown trying to be sexually provocative and sexily antagonistic a la Express Yourself, but now she is lost.

Julie: Well, she wants to be SEXY.

Natasha: Remember her Frozen phase?

Julie: I loved that. I loved Ray of Light. I loved loved Music. Confessions on a Dance Floor is her last GREAT album. I’m just worried about her mosquito in amber ambitions. The skin thing, her hair getting longer. She’s only wearing black, She only lets them shoot her from across the stadium.

Natasha: What would Madonna doing Madonna actually look like now? Without the youthful accessories and shackle shoes?

Julie: I want her to be like Anjelica Huston. But she wants to be a girl, not just a woman.

Natasha: What is ANGELICA? In essence?

Julie: Being beautiful because of a quiet confidence and deep elegance, and loveable and regal and dignified, without worrying about being matronly.

Natasha: I feel like Madge would have been amazing with just two other people and so roman slaves or cartwheeling b-boys.

Natasha: Like THIS:

Julie: She’s wearing penny loafers! Compare that to the stiletto boots. She can actually move in those, and those are her real hairs!

Natasha: When did she stop? When did the break come?

Julie: Hard Candy. I think. Some people think it was before that. But I think HUNG UP was amazing.

Natasha: HUNG WAS INCREDIBLE. It felt authentically her! With the leg warmers! And her arms and body hard as rock but still so graceful and feminine.

Julie: I don’t think being attractive to straight men is the goal of pop music. But…. when straight men are sort of revolted by you, and have so much hatred and contempt, at least in my twitter feed, you have to step back and say ‘why am i hated only in the way that those same guys hate, say, the real housewives who have had extensive plastic surgery?” Because that’s the only paralleled vitriol, not including Sarah Palin and Michele Bachmann. And it has to do with aging poorly. And not conforming to either whore OR mother. She’s in between and she hasn’t embraced the elder role. And she won’t.

Natasha: Where do you think it comes from?

Julie: Her stubborn refusal to age gracefully?

Julie: Fear.

Julie: Anger

Julie: Contempt.

Natasha: Where does the male scorn come from?

Julie: Her lack of concern for an audience different than her essentialists.

Julie: Also she’s sinewy and fat free.

Julie: So she’s not soft like a fuckable little lithe girl or a mom who feeds you from the breast. I wish the road not taken with her was visible to us. Which was: fat Italian momma.

Julie: Well, her desperation to seem and look young, in a girlish way, with long blonde hair and hot pants and stiletto boots she can’t dance in, is hugely unappealing to straight men.

Natasha: Why do you think?

Julie: It telegraphs as “crazy.”

Julie: And crazy is poison to straight men. Even coupled with hot, it’s unworkable-with.

Julie: She’s also NOT THAT OLD! Jane Fonda is in her 70s! Helen Mirren was the hot slut to profess one’s desire to boink recently! Remember how young straight guys would be like “isn’t it crazy I want to fuck Helen Mirren?” And you’re like oh wow, you’re such a feminist.

Natasha: Because she’s a perfect model?

Natasha: And has amazing symmetrical features and giant tits?

Natasha: Brave.

Julie: Right. Because she’s not 16. And the ladies on my p0rn are!

Natasha: Does Madonna still read as a ‘bitch’?

Julie: Madonna has always read as a bitch. But that’s not a problem, at least when you’re committed and urgent and vital and authentic. It’s the falseness that people see in her character. That becomes the problem.

Natasha: But she has that theater bitch thing not that aloof brat thing.

Julie: Aloofness is something she’s had to grapple with, post-Evita. And by aloof I mean pretentious. Or being seen as pretentious. It’s the only American sin. America HATES pretentiousness more than craziness, greed, pretty much everything. So moving to england, kabbalah, all that didn’t help her public image. But by then she didn’t care. And then she adopted the black boy. And her charitable efforts read like Jesus juice. Messiah stuff.

Natasha: Well isn’t also that she taps into that vital fear that she will suck out your vitality and leave you dry and/or directing Rock n Rolla?

Julie: Yes. That was the Yoko backlash.

Julie: The idea that she made Guy Ritchie a shitty director is so offensive to me. Guy Ritchie had a part in that process.

Natasha: Because he was always terrible?

Julie: If anything, Robert Downie Jr. helped!

Natasha: Are we getting the Madonna we deserve?

Julie: Maybe. (And this is me being kind, because I always will.)

Julie: She’s in her first wives club phase. This is her first divorce record, or second if you count Hard Candy. Which was all about being miles away from Guy and having nothing in common. So maybe once she settles, she’ll reinvent herself or be more comfortable being alone and perimenopausal?

Julie: But what I think is that her narcissism is so rich that she needs a wreck, like her post-Erotica backlash, in order to come back with a Ray of Light. Like, she came out last night dressed like a Phoenix rising from the ashes… but we haven’t burned her down yet. After SEX and EROTICA, America burned her at the stake. And that’s what it took for her to come back and be brilliant and genius, and enter her second act with, like, zen realness. She earned her long hair then.

Natasha: Well that is the true mark of Diva, an American Diva, one who suffers torment and mass strife and then soars.

Natasha: LIKE JENNIFER HUDSON LOLLOL.

Julie: It’s so Catholic. Hmm, in that example, what’s her cross to bear? Weight Watchers? Or her family being murdered? Remember when I made that joke? “Poor Jennifer Hudson — her family, and her breasts, are gone”?

Natasha: No but you’re a hero for doing so.

Julie: Madge needs to be destroyed, in order to be challenged.

Natasha: Do you think she’ll be destroyed for tonight?

Julie: Nope. She played it safe. Her medley was water tight. Those songs are POWERFUL.

Natasha: Remember when she rapped?

Julie: I do yoga and pilates and the room is full of hotties? That was a misstep.

Natasha: That was a fumble. (To couch this in football idioms.)

Julie: Yeah, but she recovered with Confessions. And the Drowned World tour, when she hatched from a disco ball at the top of that show, and danced around with riding crops. Post horse fall? That was some McQueen shit.

Natasha: AH YES. I miss Madonna McQueen. She needs more audacious collaborators.

Julie: She needs to make stars, not use kids. She hangs out with the popular kids. But she IS the popular kid. Stop rotating in Nicki or LMFAO or whoever else. Bring in Candy Darling. Divine. Get a new Jellybean. Break somebody.

Natasha: Is there an icon of her magnitude who has done a similar autumn of her years gracefully?

Julie: Cher. Even though her surgery cuts off criticism at the pass because of her blunt authenticity. Her consistency, unlike Madonna’s, is not desperation. She’s like the Anjelica of pop music. Cher’s sense of humor also cuts any sense of pretentiousness. Like, Cher’s won a fucking Oscar.

Natasha: TWO!

Julie: Well.

Natasha: Also: Chaz Bono.

Julie: I can’t even start. But look at Cher.

Natasha: I ALWAYS AM.

Julie: Cher will do something like Burlesque, and nobody will throw pigs blood tweets at her. That’s because she has a sense of humor about herself. She’s completely consistent with her goals and her attitudes. She does sarcasm well. And she just “seems” really authentic.

Julie: Although Madonna HAS begun smiling more in her performances, which is weird.

Natasha: Madge has always been a bit brittle in the self-deprecating department?

Julie: She smiled like three times tonight.

Natasha: I noticed that!

Julie: She’s trying to be playful. I don’t like Madonna in whimsy mode. But her smiling is her only hat tip to aging, I think.

Natasha: SHE’S IMPERIAL.

Julie: It’s one of the smallest things you can do to seem less menacing. But unless you’re Dame Maggie Smith, aka HILARIOUS, you have to smile.

Natasha: Tell that to the NYT autism kids.

Julie: Oh I would love to. I would love to spend my time explaining Madonna to autistic children. Anyway, so look. Warhol died young. Gaga is on a meth pace. She’s on a broadband track to this pop stardom/ art thing. Madonna is a living GREAT ARTIST and there are burdens to that. Look at, like, Lou Reed. Look at HIS collaboration lately!

Natasha: No. I can’t.

Natasha: Don’t make me.

Julie: But… look at Almodovar

Natasha: OK!

Julie: Or, look at Woody Allen. That guy still gets blow jobs from the Academy because of Annie Hall.

Natasha: He’s gonna get a slobbery one in two weeks come Midnight in Paris’ original screenplay winnnn.

Julie: It’s the least we can do to give Madonna a pass for a great medley she kind of paced through in bad shoes because of, like, literally, pick JUST ONE SONG.

Julie: Annie Hall — -> Express Yourself.

Julie: Crimes & Misdemeanors — -> La Isla Bonita.

Julie: Hannah & Her Sisters — ->Vogue.

Julie: You get it. And I hated Midnight in Paris. I enjoyed Hard Candy more.

Natasha: So you think she can hop back on?

Julie: I hope she can and I will be there for everything she ever does. And I will always root for her and I will always be here to defend her. But I fear she may need to be shot down to a lowness before she resurrects with the potential I still believe she has, and always will have.

Natasha: Amen.

Julie: Just one more thing. She uses young people now in the way bell hooks accused her of using queer people and people of color in Truth or Dare: both as accessories and sources from which to steal. The youth around her, now, draw attention to her flaws — AND NOT PHYSICAL ONES. (I mean, if one more fat straight guy makes fun of her appearance on twitter… Jesus. Like you’re the French guy from The Artist??) So I don’t mean her skin or her face or arms or whatever. I mean her soul flaw, which is stubborness, falseness, and contempt.

Natasha: Her soul holes.

Julie: Her little monsters are her collaborators. She’s so distant from her fans at this point they don’t even get an acknowledgment.

Natasha: I agree, I think that’s why it’s been particularly difficult to watch the whole Nicki and MIA collaboration. Those two women, you can say a lot about how much planning goes into their image and how much of a construction it all is but those constructions are working.

Natasha: Resonating. It was weird to watch them have to be stilted in her presence.

Julie: Yes.

Natasha: Madge doesn’t need to pull from their fires but it seemed like an intentional dimming.

Natasha: Or as they say… THROWING SHADE.

Julie: Yes! Paris is burning after all.

Julie Klausner and Natasha Vargas-Cooper still believe.

Tom Coughlin Wears No Clocks

“Tom Coughlin was walking off the NFL Network set on the field after the game, and Flava Flav, the guy with the big clocks around his neck, hugged him affectionately. We all, apparently, can get along.”

Prison Island Goat Ends Up In Dog Prison

This goat wasn’t kidding around! Hahaha, get it? Sigh. He had a good run, at least.

Stuff About Italy

Can Italy change? Tim Parks addresses the question here. Meanwhile, guess who this passage is describing: “When he is perorating about the inadequacies of the Italian constitution, he leans back in his yellow silk sofa, right ankle on his left knee, and runs his hand through his hair, like an emperor surveying his slaves. But when he has a meatier point to make, a defense of his sex life, for example, he leans forward and thrusts his hands up and down between his legs as if potting a large plant.”

Don't Do This, Harrison Ford

by Regina Small

Film newsy site Twitchfilm reports that Harrison Ford is “in early talks” for Ridley Scott’s Blade Runner sequel. You might remember Blade Runner as the stunning poetic meditation on the ultimate impermanence of existence. It is a film that says “we cannot possibly know how things will turn out.” Except now we will.

A reboot or prequel might have felt ill-advised, but a sequel with Ford ostensibly reprising his role as Rick Deckard is a move that feels almost inevitably disappointing and terrible. Like there are maybe a few ways that can be done right, and so very many that will inflict pain on us all. OR MAYBE IT WILL BE WONDERFUL. [Via.]

'The Daily' Is 'On Target' to 'Break Even' in 'Five Years'

Here’s today’s fascinating and maybe really unlikely media assertion from the Times: “A $30 million tablet-only news publication… with 100,000 subscribers paying 99 cents a week or $39.99 a year, and 250,000 unique readers each month, The Daily is on target to break even in five years.”

Hooray! They made it! Just five short years to breaking even. Well, it… could be.

“News Corp. has spent $30 million on development (which has been ‘written off’) of The Daily and current costs are less than $500,000 per week,” according to Folio, a year ago. Okay, so maybe if you attributed the original $30 million to News Corp. itself and disregard it, that’s… possible. Business Insider: “Add $30 million to startup and $26 million per year, and The Daily cost $56 million to run in year one.” Now, I don’t think it came to that; I think the $30 million was more like start-up costs and two years of budget. Even so: Nieman Journalism Lab estimated “$13.5 million in annual staff costs,” at 150 employees. (But I think it’s fewer than that, more like 100 employees. So correct that downward to… $8 or $9 million.) In the end, even ditching the $30 million from the balance sheet (which most media companies don’t exactly get to do), and skewing the staff downward and then assuming that all 100,000 subscribers are paying full freight, that’s still only conceivably at most $5 million a year in subscriber revenue. (I’d be charitable and throw in another million a year for web advertising, but the only ads I ever see on web content are for The Daily itself.)

So by what possible metric can the Times make the claim the paper is “on target to break even in five years”? (“On target” being a favorite vague-ism.) What possible growth trend forecast do you have to buy from the publisher to accept that as fact?