Knifecrime Island Glassing Victim Speaks Out

Greetings from Britain, “the glassing capital of the world”:

I was glassed/bottled once a year for three years running. The first happened in Southport because I was wearing a long scarf. The third time was for accidentally spraying somebody with beer in the Old Blue Last. The second, and worst, was on Charing Cross Road in London by a guy who attempted to smash a bottle on the wall three times to stab me. I laughed at him but then he smashed the beer bottle in my face and ran off while his girlfriend cried: “Oh my gawwwwd. What ‘ave you done!” I put my hand to my head and felt a four-inch flap of skin come lose from my head.

This account offers some sociological explanations for the prevalence of glassing in Knifecrime Island, but I have my own theory. I read an article in this weekend’s Telegraph about the decline in popularity of marmalade in that island nation.

The tangy spread is vanishing from the nation’s breakfast tables — along with, it must be noted, the breakfast tables themselves. The scoff-as-you-go culture of a society in headlong retreat from the civilised rituals that once held it together doesn’t have time to sit down over poached eggs, buttered toast and splodges of amber goo.

Curious, I made my way to the grocery to procure some of this apparently magical condiment. Having somehow managed to make it thus far in life without availing myself of its reported pleasures, I reckoned now was as good a time as any to try it. And you know what? It is some NASTY, BITTER shit. I have to believe that the Britons of old spent so much time scraping it off of their goddamn tongues that they never had the time or inclination to go about stabbing their countrymen. Now, what with its disappearance, they’ve got all the experience of using sharp objects but no time-consuming tongue scraping duties to distract themselves with. Naturally they’re going to get up to no good. As our glassing correspondent has it, “If you’re a dedicated British drinker who doesn’t restrict himself to drinking in the same safe gentrified hipster bars every night then being attacked with some kind of weapon is not just something you need to be mildly worried about. It’s something that you must accept as normality.”

Explaining Metropolitan Diary, Part Two

Sometimes the Monday “news and notes from weird readers from all over” column in the New York Times baffles. (See: previously.) Today offers a fascinating example that may baffle you if you are not deeply immersed in the culture and its assumptions.

It goes like this.

Dear Diary:

Two years ago on Valentine’s Day, my mother, who had recently celebrated her 70th birthday, swiped her reduced-fare MetroCard at the Kings Highway station in Brooklyn on her way to work.

A young police officer had taken note. Mom turned around on the platform in response to his tap on her shoulder.

You see, in America, the police come up and touch you when they have questions about your behavior. Fortunately, she did not mace him.

“Excuse me,” the officer said. “May I see some identification?” As she rummaged through her big tote bag for her wallet, Mom felt the office [SIC] scrutinizing her.

“Why do you need my ID?” Mom asked. The officer replied that he had seen her use a discounted MetroCard. “So?” Mom asked, as she handed the officer her driver’s license.

His eyes widened in surprise when he calculated Mom’s age from the birth date on the license. “Keep up the good work, lady!” he said, as he handed it back to her. Mom said it was the best Valentine’s Day present she could have gotten.

Confused? Don’t be!

This incident of being detained by a police officer, accompanied by a demand to produce identification, was just a charming and light-hearted way for a man to tell a woman that she sure looked good for her age! Make sense now?

It’s mostly like a good thing she chose to produce the ID. Of the 600,000 or so stopped by New York City Police (50% of whom are black and 10% of whom are white), about 10% are arrested. (N.B. Those two 10%’s don’t actually overlap that much!)

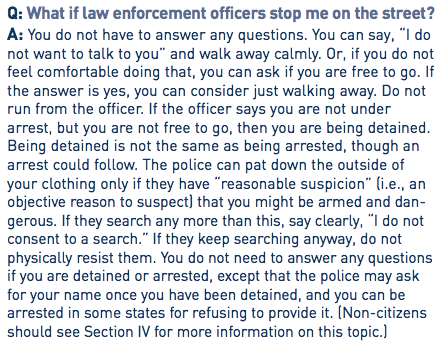

For more information on being stopped and touched by the police, followed by a demand for your ID, you can read more about your rights thanks to the ACLU.

For more information about being charmed by being thought of as much younger than you are, go read, I dunno, Cathy Guisewite or something.

Paterson's Spokesperson: Thin Air! Innuendo!

Paterson’s Spokesperson: Thin Air! Innuendo!

Nothing to see, says Governor David Paterson’s spokesman!

Also There's A Long Malcolm Gladwell Thing About Booze? Screw You, This Day!

Um, Adam Gopnik kind of liveblogged the Super Bowl? No matter. NOTHING can take away my joy over the Saints’ victory.

Soda Will Cancer Up Your Pancreas

Here’s another reason to not drink soda: It might give you cancer, right in the pancreas. “People who down two or more soft drinks a week may have double the risk of developing deadly pancreatic cancer, compared to non-soda drinkers, new research suggests.” There are some questions about the methodology (and some nasty insinuations that maybe smoking will give you pancreatic cancer, which WAS NOT PART OF OUR DEAL, nicotine-I signed up for lung cancer only!) but I think from now on I’ll stick with tonic or seltzer for my mixers.

The Heart of the Andes

This weekend’s Wall Street Journal had a nice appreciation of Frederic Edwin Church’s “The Heart of the Andes,” which happens to be my favorite painting. I have spent countless hours at the Met just sitting in front of it and taking it in, and I never get tired of it. No matter how perfect your computer’s resolution, seeing it on the screen does it no justice; the next time you’re uptown you should definitely go take a look.

Neutral News and the 'Times' in Jerusalem

This weekend’s New York Times’ public editor column was yet another doozy, covering the semi-recent news that the paper’s Jerusalem bureau chief’s son recently joined the IDF (before he traipses back to America to go to college). That the kid is going to great lengths to undermine his father’s longstanding career is fascinating but we’ll leave that for their family therapy sessions, about which: whew, good luck. Hoyt’s column is unbearably dull until near the end, when he suddenly takes a side: “The Times sent a reporter overseas to provide disinterested coverage of one of the world’s most intense and potentially explosive conflicts, and now his son has taken up arms for one side.” That’s both rather stirring and accurate! Still it doesn’t have too much meaning beyond emotional appeal.

Particularly because Hoyt’s reasoning along the way, once again, for the removal of Ethan Bronner from his post in Jerusalem, stopped making sense:

Alex Jones, director of Harvard’s Shorenstein Center on the Press, Politics and Public Policy and a former Pulitzer Prize-winning reporter for The Times, took a different view. “The appearance of a conflict of interest is often as important or more important than a real conflict of interest,” he said.

It is? It is not! How is an actual undermining conflict of interest devaluing news ever possibly worse than something that people might see as such but isn’t?

In any event, the paper’s executive editor responds with a long-winded no-thanks to the offer to retire the bureau chief.

In the Times, there’s not much coverage of the IDF anyway-there’s one story in the last 30 days that isn’t related to Israeli misgivings over aid to Haiti. That one story was about Israel’s preparation to issue a response to a UN report (with which Israel refused to participate) that said that the IDF’s official policies were clearly intended to terrorize Palestinians in last year’s attack on Gaza.

The story covering the Israeli reaction is a he said/he said to the nth degree. The UN report says that Israel deliberately bombed a sewage treatment plant and the only flour mill in Gaza. Also 4000 homes. And killed 1400 people. Israel says that Hamas actually blew up the plant and everything else was an accident. One of those things is certainly true (I dunno, I have some suspicions!) but Bronner, now more than ever, must present objective, neutral copy (see also: teaching the controversy) or else he’ll be accused of shilling for his son, so it’ll take us a long time to get the truth, at least from the Times.

The Future Of America Is Written On Sarah Palin's Hand

I suppose we should discuss HANDGATE. Did former Alaska governor Sarah Palin write something on her hand to help her remember her answer to a pre-screened question during this weekend’s Tea Party convention? Is it a big deal? Can we resist making teleprompter comparisons? I don’t know. I still think the idea that Sarah Palin will be president is a completely overblown fear of folks who, either out of frustration or a general contempt for the intelligence of the American electorate, somehow believe that we would ever vote for someone so manifestly unfit for the office. On the other hand, you look at recent history, and, well, you can sort of see what they’re worried about. Ta-Nehisi Coates says that this is “what happens when you turn conservatism into nothing more than the white populist id.”

What you have here is a party being eaten alive by the hate that they stoked for decades, dumbasses who think the essence of “Real America” is stupidity and ignorance, who’d sooner have a president who packs a cheat-sheet to a tea party, than a Indonesian/socialist/nigger/Muslim. Soon we’ll know if they’re right.

I guess we will. This must be the “interesting times” they’re always talking about.

Alan Greenspan's Window Is Always Open

Well, this is awkward. Alan Greenspan, hailed for most of his nearly two-decade run as chairman of the Federal Reserve as a market savant of the first order, is now assailed from all sides for the Fed’s apparent role in overinflating the country’s garish housing bubble. The charge is a fraught one, reports Fortune magazine’s Geoff Colvin, since should it stick, it will fundamentally reshape perceptions of Greenspan’s legacy at the central bank. Already the sweep of the emerging indictment is such, Colvin writes, that “four years after leaving the Fed as the Greatest Central Banker Ever, the longest-serving chairman, the Maestro, Alan Greenspan is the designated goat.”

But Greenspan is not a goat who will go quietly into the good night. He takes vigorous issue with the criticism of Fed policy that is now fueling all the anti-Greenspan rancor: that from the pivotal years of 2002 to 2005, when mortgages remained artificially low and housing prices continued to drift ever higher above the realm of consensual reality, the Fed failed to put the brakes on the downward drift of interest rates. This critical oversight, Greenspan’s critics charge, meant that the Fed kept pumping the derivatives-fed fiction that no serious risks were accruing in the market long past the point of any empirical support.

Greenspan’s rejoinder is that the true causes of the 2008 housing crash were global-that prices kept spiraling upward because of a global savings glut, which channeled capital’s insatiable quest for exotic new forms of market expression into the opaque wonderland of securitized debt. Emerging market economies such as China kept unleashing new investments that, Colvin writes, “naturally pushed interest rates down globally-thus the decoupling of mortgage rates from the Fed funds rate, and the global nature of the housing boom.”

To detractors who point out that this upsurge of global capital didn’t really so much, you know, exist, Greenspan has an elegant rejoinder. As Colvin summarizes, it goes as follows: “You have to look at intended saving and intended capital investment, not actual saving and investment. After all, saving and investment by definition will always balance.” The mere existence of an overabundance of capital was enough, in other words, to prompt markets across the globe to keep their mortgage rates artificially low-thereby permitting housing prices across the globe to ratchet up ever higher.

There’s an obvious let’s-change-the-subject quality to the global credit argument. It seems akin to a kid finding himself in the custody of school truant officers, blurting out “Look over there-China!” and hotfooting away from his distracted captors in the other direction. For one thing, if the glut of intended investment capital holds the markets so powerfully in its mystic sway, one might expect the bubble to have taken off when all the pent-up savings from former command economies began flooding the markets after the mid-nineties collapse of communism. Nothing of the sort occurred, of course-many of those funds flowed into currency and tech markets, which hosted bubbles of their own, to be sure, but nothing anywhere near as calamitous as the one that crashed to Earth in 2008.

And whatever power one attributes to hulking reserves of intended global investment capital, the U.S. economy certainly hasn’t been neck deep in savings over the past few decades-quite the opposite, in fact. Household savings rates hit zero in mid-2004, and went into the negative column in 2006-the first time households gave up saving since the bleak Depression year of 1933. Wall Street responded to this development not with the tonic of fiscal restraint, but by treating spiraling debt as though it were in fact capital. And while the U.S. investment economy continuing burrowing down this rabbit hole, Greenspan’s Fed looked placidly and indulgently on.

Indeed, Greenspan’s track record on the fallout from securitized debt strongly suggests that the failures of his Fed regime were not so much technical-misreading the proper market cues at a critical juncture in the mounting housing crisis-as they were ideological. It’s bracing in this regard to revisit the Fed’s role in the famed derivatives-fueled crisis of the late-nineties, the rescue of the Long-Term Capital Management hedge fund.

It’s quite remarkable, in hindsight, to note the many structural affinities between that bailout-which permanently moved the term “Too Big to Fail” into the nation’s political lexicon-and the market conditions that produced the housing meltdown a decade later. When the fund seized up in 1998, rolling financial crises in Asia and Russia helped persuade Fed regulators that LTCM’s failure would grievously distort securities prices in U.S. markets, and Greenspan, largely accepting the fund’s explanation that it got swept up into an unforeseeable run of bad luck, organized a Fed-orchestrated buyout. (The overall market wasn’t in the same free fall that it would be in 2008, so the government didn’t siphon cash directly into the fund, but rather marshaled a consortium of banks to raise the necessary capital.)

In his excellent chronicle of the episode, When Genius Failed, financial journalist Roger Lowenstein revisits the main objection to the Fed’s plan-that it would create what’s called a moral hazard by emboldening swashbuckling speculators in derivative markets to believe that the Fed would always protect them against the mortal consequences of their bad decisions. But, as Lowenstein goes on to argue:

Greenspan’s more consistent and longer-running error has been to consistently shrug off the need for regulation and better disclosure with regard to derivatives products. Deluded as to the banks’ ability to police themselves before the crisis, Greenspan called for a less burdensome regulatory regime six months after it. His Neolithic opposition to enhanced disclosure-which, because it allows investors to be their own watchdogs, is ever the best friend of free capital markets-served to remind one of the early Greenspan who (in thrall to Ayn Rand) once wrote, ‘The basis of regulation is armed force.’

And Lowenstein’s estimation of the core lesson the Fed failed to heed in the whole LTCM mess has an especially prophetic ring for those of us condemned to live in the wreckage of its long-term policy aftermath:

If the Long-Term episode proved anything, it is that the system of disclosure that worked so well with regard to traditional securities has not been able to the job with respect to derivatives contracts. To put it plainly, investors have a pretty good idea about balance-sheet risks; they are completely befuddled with regard to derivatives risks…. Why, then, does Greenspan endorse a system in which banks can rack up any amount of exposure that they choose-so long as that exposure is in the form of derivatives?

Why, indeed? Hey, look over there-India!

Chris Lehmann is definitely too big to fail.

Automobile Ad Heats Up War Between The Sexes

This ad, for the Dodge Charger, seems to have pretty much infuriated every woman who saw it last night, which is what you gals get for watching The Big Game. Here’s a pretty cute insta-response, but let’s be honest: Men are under siege. It has never been tougher to be a man than now. Unless you’re at college, where it is apparently a never-ending parade of blowjob parties no matter how ridiculous your retro headgear looks. Anyway, the ladies keep yammering on about this one, which they probably should. I mean, no guy REALLY puts down the seat, am I right?