Ukrainian Legislature Eggings Preferable To Sitting Through Anything Involving Tom Coburn

In case you have not yet seen this video of irate Ukrainian legislators tossing eggs, tomatoes, and smoke bombs at each other in a dispute over allowing Russia to continue using Black Sea port, by all means do watch: It is certainly more exciting than listening to a bunch of Senators use bad words. It may seem shocking and unparliamentary until you consider the fact that the lawmakers already had umbrellas on hand in the chamber. This is probably just the way they do things on Tuesdays.

Angry Record Store Patron Not Really Sure What He Wants, Except That He Wants It Now

Have you ever read one of those pieces that just made you say “ugh” over and over while reading it, even while you agreed with a few of the points within? Sam Machkovech’s piece on the current role of the record store gave me that exasperating feeling, thanks to his trotting out a few hoary clichés (record store clerks are snooty!) while making a few decent points (most of which regard the indie-NPR bent of many of this country’s remaining record stores).

Basically he’s trying to argue that in the age of the Internet, fans don’t really need to have awkward encounters with shop employees in order to suck down the music they want — they can instead browse “free MP3s on blogs, BitTorrent sites, and [their] friends’ USB sticks.” Which, I mean, I guess? This is something of a Urban Person Problem, as it’s not like there are a ton of independent record stores still making their way in the suburbs. (A not-perfect but still-illustrative data point: One of the Long Island record stores operating in 1971 is still operating; it’s a former Record World that’s now an FYE.) But regardless: To prove his point that Record Stores Just Don’t Cut It These Days, he visited a local shop earlier this month — on the day after the indie-store celebration Record Store Day, as a matter of fact — in search of a record by the lovely Baltimore duo Wye Oak. The clerk is not sure of exactly who the band is, but eventually he navigates his way toward a CD of theirs and purchases it, even noting the store’s helpful role in that transaction taking place; “I can’t say I’d have bought the CD if I’d hadn’t listened to it at a spacious store’s listening kiosk or hadn’t been reminded by the gig poster. A MySpace listen doesn’t always translate to an iTunes spree,” he writes. But what did his not-on-assignment friend think of the whole experience?

My friend who joined my experiment, a casual music fan who doesn’t buy music at Best Buy, gave me a one-word review of her experience with me: “Boring.” She looked at the racks with a blank stare, not knowing much about the artists and finding the little handwritten notes insufficient proof of the quality. It’s not that she didn’t want to buy anything; she just didn’t know where to start.

The next day, I ripped my Wye Oak CD to my iPod and gave her the CD. She loved the recommendation. She’d love many, many more.

Machkovech treats his personal victory as a failure of the record store. But isn’t the disconnect here embodied in the word “casual”? It shouldn’t be surprising that someone who just likes music on a non-obsessive level isn’t going to be so into delving blindly into the teeming racks of a record store; that’s like expecting me, as a casual fan of football, to dive right into a pile of statistics and start picking out a fantasy team. (Although I’d probably describe my experience to whatever friend asked me along on this encounter with a term that’s a bit softer than “Boring,” ahem.) Of course I’ll take recommendations from friends, who know me and my proclivities, over handwritten cards, no matter how spikily interesting the script on them might be. (And it’s worth noting that his own description of Wye Oak — “the female-fronted, morphine-drip Americana of Low took on some of the urgency and bleeding-guitar tricks of Autolux” — might cause those casual music fans outside of his social circle to glaze over as well.)

Machkovech’s rant is ostensibly about “music fans,” but he fails to note that it’s the lack of paths into music for the more casual fans out there that has definitely helped put music sales — whether they’re at big-box stores or carefully curated shops — in their current precarious position. (Casual swapping of a USB drive’s worth of music during a night out with friends doesn’t help much, either.) Recommendations by friends are one of the few avenues of introduction left for people who don’t spend their leisure time bitching about Pitchfork’s number ratings and M.I.A.’s Tweets. Combine that with the bitter aftertaste still felt by people who had to deal with the $14.99 maxi-singles that were released as “albums” during the major labels’ Great War Against The Single and the ever-shrinking amount of real estate devoted to selling music everywhere, even at ostensibly music-centric outlets, and it’s not hard to see why the casual fan might find a thicket of options frustrating and subsequently go back to whatever they already had on their iPod.

Let’s wrap this up with a recommendation, shall we? At least Machkovech made it easy for me; Wye Oak is a singularly amazing band, and Jenn Wasner’s rich alto is one of my favorite voices in all of music right now. Here’s the aching “For Prayer”:

[Pic via]

The "Brief Safe" Seems Like A Crappy Way To Hide Your Valuables

“Items can be hidden right under their noses with these specially-designed briefs which contain a fly-accessed 4” x 10″ secret compartment with Velcro closure and ‘special markings’ on the lower rear portion… even the most hardened burgler [sic!] or most curious snoop will “skid” to a screeching halt as soon as they see them.” Oh yes, there’s a photo. [Via]

Goldman Sachs Self-Evaluations Contain Grotesque Bonus-Grubbing

The Senate sub-committee hearing on Just How Evil Is Goldman Sachs, ongoing for a few hours now, is numbing and ridiculous and unintelligible. Alternately I have the impression that the people asking the questions and the people giving the answers have no idea what they’re talking about. The constant use, by the questioning politicians, of the idea and model of “gambling” in relation to what Goldman Sachs does is somewhat disturbing. Goldman Sachs is, at heart, a math organization. What happens there is that thousands of incredibly bright math-oriented folks are modeling and running numbers constantly, and when the numbers seem worthwhile, choices are made. It’s like gambling only if you were playing blackjack with shoe composed of several thousand decks of cards with a dozen people counting cards and running probability numbers for you. John Ensign is particularly a moron, it seems to me. (“In Las Vegas people know the odds are against them,” he said. “On Wall Street they manipulate the odds while you’re playing the game… much more dishonest.”) This is grandstanding and, to say the least, not helpful. What did strike me as interesting in the documents released by the Senate were the performance reviews. They are pretty absurd.

These are from end of year 2007. Here is self-review filed by Daniel Sparks, a Managing Director at Goldman:

I delivered the best performance of my career this year to the firm. I led a great team through an incredibly volatile and challenging market, we had to change business approaches dramatically and constantly, we levered the firm’s support, and we didn’t just survive — we excelled. Below I have listed significant contributions and accomplishments.

No, how do you REALLY feel about yourself? And when MD Joshua Birnbaum filed his own self-review, his only criticism of himself was essentially that no one would listen to him and he should have insisted about how he was right more often: “As a leader with significant experience quantifying and managing a wide range of mortgage risks, I could have spoken even louder and tried to piece together something to support my assertion that other areas were quite long and in need of incremental hedges.”

And MD Michael Swensen:

It should not be a surprise to anyone that the 2007 year is the one that I am most proud of to date. I can take credit for recognizing the enormous opportunity for the ABS synthetics business 2 years ago. I recognized the need to assemble an outstanding team oftraders and was able to lead that group to build a number one franchise that was able to achieve extraordinary profits (nearly $3bb to date).

You can see the Goldman thing poking through-”Though this extraordinary year is attributable to a total team effort, my commercial contributions over the past year are numerous.”-but even while they make nods toward emphasizing teamwork and the group, the big boys just can’t stop sucking up for extra bonus cash. They’re so unanalytical and so unforthcoming, it makes a joke of the company’s intense review structure-and that to me, reflects more poorly on them than the emails with swearwords in them. (OMG swearwords! In a work email! Can you imagine? Oh right you can.) I know it’s pretty common corporate practice, this sort of horn-blowing-and it’s probably much worse at other finance firms!-but to me, it just seems sad and pitiful.

Today In Unlikely Endorsements: Misshapes For 'WSJ'

“I haven’t read it, but I hear it’s really good.”

-Misshapes DJ Geordon Nicol, who worked last night’s launch party of the Wall Street Journal’s Greater New York section

with his crew, on the paper’s new metro package. You can see a picture of the trio on page A26 of today’s Greater New York, directly across from the full-page ad for Robert Half International (“the world’s first and largest specialized recruitment firm focused exclusively on the placement of finance and accounting professionals”).

Jersey Mayhem: That Depends, What Kind Of Tastykake Are We Talking About?

A New Jersey man was arrested in Asbury Park Friday for offering an undercover police officer $10 and a box of Tastykakes in exchange for a sex act. The specific type of Tastykake has not been disclosed. I’m guessing cupcakes or mini pies-probably the apple or the cherry-because if it was either the Butterscotch Krimpets or the Peanute Butter Kandy Kakes, no way any New Jersey cop turns that down.

Adorable Rodent Gives Good Paw

You will probably want to look at this picture of a man shaking hands with a squirrel, because, you know, awwwww!

Adding Pounds For Good Behavior

The institutional-food giant Aramark’s iCare program — which allows people to send care packages of meats and sweets to their pals who are incarcerated at Aramark-served facilities, while also allowing correctional departments to rake in the revenue — gets the Wall Street Journal treatment today, complete with quotes from weight-worried inmates (one man whose daughter regularly sends him chocolate has gained 10 lbs. while in jail) and irritated Nutraloaf devotees at other jails. It would seem that there’s an odd class element introduced by these pricey packages as well, given that the junk food is actually less junky than the prisons’ normal offerings: “Mr. Yonts said hundreds of inmates and guards have complained to him about Aramark’s food, citing spoiled milk and meals contaminated with mouse droppings.”

Haven on Earth: How Far Rich Folk (Like Mike Bloomberg) Will Go To Avoid Taxes

by Mark Bergen

Mike Bloomberg is an extremely generous rich man. Arianna Huffington dubbed him one of her “Game Changers” in giving, so you know it must be serious. With his $1 salary and relentless check-writing, the NYC Mayor is practically the Platonic ideal of a charitable tycoon: our Philanthropist-King.

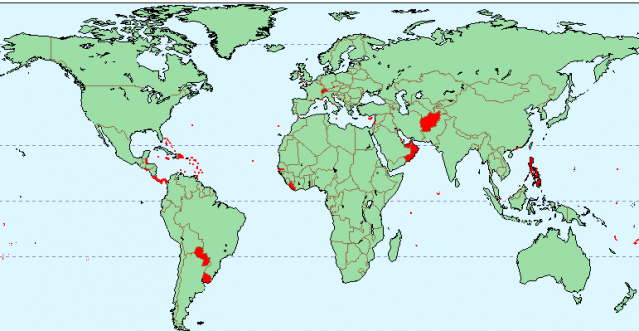

All that benevolence looked pretty petty, however, when news broke that his charity invested so as to keep tax payments out of the U.S. The New York Observer unearthed the documents that show how the Bloomberg Family Foundation’s money management team shuffled nearly $300 million into far-flung tax havens. The reporters smartly cull up a sarcastic quip from then-candidate Obama, pledging to tackle tax haven abuse head on. Too bad his tackle turned out to be just a light shove.

Sizable nonprofits like the Bloomberg Family Foundation that enjoy making sizable investments are subject to something called an Unrelated Business Income Tax. To sidestep tax, the Foundation allowed off-shore havens to make investments for them. Such a maneuver, an artfully vulgar Law professor told the Observer, “cleanses the unrelated business taint from the total return.”

All this taint-cleansing is perfectly legal. It’s just opaque and more than a little seedy. The delicious irony is that all this transpired while Bloomberg was forcefully condemning a statewide “Millionaire’s Tax.” It would, the Mayor said, in another iteration of his belief that various normal tases and costs are upsetting to rich corporations and people, spell the rapid exodus of richies and their tax dollars. All this concern occurred while Bloomberg stuffed $19.7 million alone into advantageous situations in his Bermudan home-away-from-home.

These revelations about Bloomberg only serve as a reminder of how serious financial reform can sputter, melt and just die.

For the incoming Changemaker-in-Chief, this was low-hanging fruit, a softball lob. Here was a clear example of corporate cruddiness as the country plummeted into economic recession. Stomping out tax havens plays to populist sentiment on the right and left, particularly as both sides trip over one another to pull up the covers and find the other canoodling in bed with those damn fat cats.

Last May, the new Administration trumpeted new reforms to overhaul the global machinery of tax evasion. Obama came out like a vigilant watchdog, promising to “detect and pursue” homegrown evaders. A package of enforcement measures, scheduled for 2011, would create hurdles for potential tax cheats and generate $43 billion over the next eight years, somehow. Even Treasury chief Tim Geithner, regarding whom there were concerns about his own tax flaws, supported the measure, chiding the loopholes that allow companies and “well-off citizens to evade the rules that the rest of America lives by.”

But then the molasses wheels of the legislative branch failed to to turn their spokes. Two month before Obama announced his plan, Senator Carl “Goldman Sacker” Levin introduced his Bill, aptly titled the “Stop Tax Haven Abuse Act.” It was full of measures to deter and restrict the use of, obtusely, “transactions involving offshore secrecy jurisdictions.” Co-sponsored by a measly five Senators (four Democrats, one indefatigable Democratic Socialist), the Bill was read twice (twice!) then sent to rest at the Committee on Finance.

A counterpart Bill in the House, introduced by a Democrat Texan named Lloyd Doggett, remains in a Subcommittee purgatory. In 2010, Wisconsin’s Russ Feingold wrote a Senate Bill about tax code revision with language on tax haven abuse buried inside. It does not a have single cosponsor.

Now, Congress has scores of excuses for not completing serious haven reform. There was the endless health care debate, immigration, climate change, Maryland basketball. Plus, they are taking on a commendable overhaul of the entire dysfunctional financial system. (And, by “they,” I mean the legislators who aren’t Senate Republicans, or named Ben.) But the 1336 page Senate Bill makes not one mention of tax havens.

A much more cynical explanation — and, probably, the depressing accurate one — rests at K Street. Six governments, home to the heftiest havens, dropped $2.3 million in lobbying fees, according to 2008 disclosures, to push their hundreds of contacts on Capitol Hill against tax haven reform.

The recent Jobs Bill, so says a tidbit buried in an AP report, will be paid in part by the tax haven crackdown. It’s a little unclear what this means. Marginal progress was made internationally when the Organization for Economic Cooperation and Development and the G20 summit agreed to ebb the $11.5 trillion flowing in havens internationally. But a recent report found this effort “lacking teeth.” Lobbying efforts from haven countries have defanged the crackdown, and Caribbean nations are crying fowl about double standards.

Perhaps reform efforts will be ignited as the U.S. Government starts to wrestle with the giant vampire squid. Add to their growing list of dubious (or at least offensive-looking) doings a plot to dupe foreign investors into buying mortgage-backed securities via a “shell company” in the Cayman Islands.

Bloomberg denied knowledge of the off-shore shuffling. While he has been in office, his investments are “blind” to him-though he does sign the overseas tax returns.

The Mayor once plugged a book called “Philanthrocapitalism,” a title that accurately describes his brand of high-profile altruism. Of course, the Mayor giveth, and surely it is within his rights to no longer giveth. In March, he quietly pulled his backing from a charitable enterprise that funds a huge number of the city’s arts and social services. This move would free up time to focus on his beloved Foundation “as he prepares to put greater emphasis on needs in the United States.”

Mark Bergen uses TurboTax.

Preserve Your Precious Memories On Old Doody

“We’re taking material which is of little productive use and turning it into something functional, and useful and conveying a message of sustainability. Our product conveys hope and the possibility that if you can take something like poo and turn it into paper without cutting down trees, what other things can we do to chip in and waste less and consume less.”

-Alternative Pulp and Paper founder Michael Flancman touts his company’s Poo Poo Paper, a collection of “stationery, journals, photo albums and other paper products [made from] elephant, horse, cow and panda dung.”