New York City, November 19, 2012

★★ Sun and clouds traded off over Manhattan early. There was enough of the former to wake up to, through the perforated windowshade. But midday, under the girder shadows of the Queensboro Bridge, was dim and getting dimmer, save for a gleaming patch on the East River. Some forty-five hours earlier, in the adjoining airspace, the golden hour had gleamed through the clean and glassy tram to Roosevelt Island. Now there was the ride to the gray-tan concrete of the L.I.E., under gray-tan clouds. Only the foliage of Forest Hills was vivid, even in the dull light. The return trip, on the high approach to the Midtown Tunnel, laid out the entire skyscape: a dark blanket — one of those grimy felt ones from the back of a moving van — spread east and south over Queens; to the west, above the skyscrapers, were broken clouds and daylight, with one tasteful cumulus formation spanning the river. Manhattan had claimed a full share of illumination. The Traverse was aglow. After sundown, a fat crescent moon still shone.

Your Expanding Gut: Scientific Reasoning

Here is a scientific explanation for the reason that, even though you have gorged yourself on turkey and stuffing and potatoes and cheese and a bunch of bread and whatever else you’ve crammed down your gullet, you’re still all, “Yeah, I could have some pie.”

A Poem By Mark Bibbins

Here you will find a poem by Mark Bibbins, who just happens to be the editor of our Poetry Section. Go read it, it will make you a better person.

An Unexpected Masterpiece

As National Novel Writing Month continues on, the next in our series about the novels that we started writing but, for whatever reason, never finished.

The novel I never wrote is spotless. Every sentence is a sickening surprise. The plot coils round you like a python. Your eyes water badly at the humanist climax. You do not trust this response.

It is three hundred and twenty-nine pages long. It is at least fifty-four percent true and took six days to write. Seventeen people conspired against it, and each died under odd circumstances.

The text is political but not polemic, learned but not dense. It is charged with alarming ambiguity and wrought with alarming clarity. Portions all but beg to be carefully read aloud, alone or as foreplay.

There are descriptive passages with the power to kill a small horse. The dialogue’s electricity could power Switzerland for weeks. Supporting characters were bought and licensed by Viacom Inc.

An excerpt appeared in The Paris Review. An amusing controversy attended publication, bloomed into industry scandal, and finally engulfed the literate globe in archly hot opinions.

The following adjectives were applied by reviewers, pro and amateur: disastrous, dialectic, decadent, startling, cruel, stark, indecent, far-fetched, morbid, timely, timeless, hollow, trashy, suicidal, correct.

The hardcover is embossed, its paper deckle-edged. The softcover is improbably small — fits in a jacket pocket. My wife picked the title, my mistress the font. Neither speaks to me now.

The sex is an unspeakably genuine sequence of aperçus, flowing from a properly curious psyche. Regardless, it is not widely selected for book clubs. The dedication contains a mysterious set of initials.

Translations are available in German, Japanese and Spanish. In France, it’s been adapted into rhyming verse. A Brazilian choreographer has staged the ballet for an empty house.

While included on several shortlists, no jury agreed to saddle it with something so tawdry as an award. The Nobel Prize Committee remarked that its towering achievement would dwarf the highest praise.

At least one heavily echoed bon mot caught on as slang in the wider world, where it is often malapropised. Another writer rankled at what he took to be (and what surely was) an attack on his silver reputation.

Royalties are distributed throughout Hollywood to permanently obstruct a film. The audiobook is said to alleviate arthritis pain. Libraries find that they cannot hold on to their copies.

A pulverized edition was found at the site of a recent asteroid impact. Birds wouldn’t use the shreds for their nests. The opening is temptation itself. The ending is a bit of a shock.

The idea arrived from what seemed a second mind, cold and all but insensate. Given that this numinous phantom has nearly approximated life, the rest of us lack any excuse.

Previously in series: My Unrealizable Postmodern Novel

Miles Klee is the author of Ivyland.

Blame Your Lack Of Cash On Your Sad Childhood

Did you have a happy adolescence? Of course you didn’t. You have a brain, don’t you? It didn’t take you long to realize the futility and suffering of existence, did it? Well, guess what? “UK researchers say the first in-depth investigation of whether youthful happiness leads to greater wealth in later life reveals that, even allowing for other influences, happy adolescents are likely to earn more money as adults.” The happy idiots win again. Life is just unrelenting gloom, isn’t it? Plus you’re poor.

'Red Dawn 2: Yellow Peril': White People Finally Win One

by Abe Sauer

One of the links passed around Twitter by China watchers yesterday was a photo gallery of “little warriors playing the game ‘Defend the Diaoyu Islands.’” (The Islands being the disputed territory that sparked the nation’s recent anti-Japan protests.) Armed with plastic assault rifles and (adorable!) berets, the children completed boot camp-like obstacle courses such as shimmying under razor wire (kidding; just string) while gripping tiny Chinese flags in their mouths (not kidding).

It’s been two-and-a-half years since we first wrote about the Red Dawn reboot after coming across an early script. Then, the film’s original 2010 release date was postponed; in the interim, the army invading America was changed from Chinese to North Korean.

And now, it’s here. One adult Youtube user in America was so inspired by this Thanksgiving’s release of the rebooted Red Dawn that he filmed the series “The Road to RED DAWN,” all about how to “defend America from North Koreans.” His guns were not plastic. In the videos, your host Brandon proceeds to “shoot this guy up with a whole bunch of other stuff.” “I got some incendiary shotgun rounds,” Brandon teases, before firing them with no result.

But Brandon makes up for his shotgun’s lack of incineration when, because “this guy looks like he’s on his knees,” the host executes the North Korean General Nguyen Ngoc Loan-style. Though Brandon “is not usually a fan of execution style kills,” he reasons, “we live here and they don’t.” Hey Republicans, I think we found an architect, spokesman and catchphrase for your new immigration platform.

But don’t judge the show just by its Red Dawn material; “Dual Wielding AK-47’s” [sic] looks exactly like the kind of “responsible gun owner” educational program the NRA is always talking about. (Go watch the episode now before Obama outlaws guns on Youtube.)

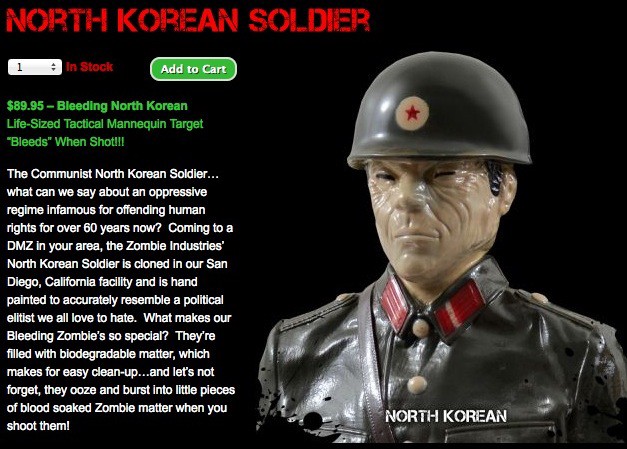

“This guy,” the target in the videos, is a life-size (get it, because they’re underfed) North Korean soldier target manufactured with embedded “blood” packets so he bleeds when you shoot (KILL) him. Of course the targets are only for fun, because we all know North Koreans don’t actually have blood but instead acidic goop that, if touched, will make one favor single-payer healthcare. (Also, the women have sideways vaginas.)

You can get your own “Bleeding North Korean Life-Sized Tactical Mannequin Target” for just $89.95:

“Each Patent Pending Soldier is cloned in our San Diego, California facility and is hand painted to accurately resemble a North Korean Soldier that just finished spreading his Communist oppression, to give you that realistic look so you genuinely feel the hate.”

Also available, a bleeding Osama bin Laden “Terrorist” target just in case any red-blooded American gun owner wants to play the game “American President Barack Obama.”

As for the film, a review of an early version said the film contained a line about how the blue states have already been subdued thanks to their restrictive gun control laws, leaving only the red states and their weapons stockpiles to fight off all the North Koreans. Though, as the movie takes place in Washington — a blue state — it seems the film may suffer from at least one technical inaccuracy. Also, the original script contained the line:

“Cue Toby Keith’s ‘Courtesy of the Red, White, and Blue.’ As the Wolverines listen, they actually manage a few smiles — “

If that’s been removed, Americans should rise up and kill the spineless Hollywood communists that watered down the original story just to pander to copyright attorneys.

But a personal favorite passage from the original script was about Mao:

JED (O.S.)

When I was over in Baghdad…

They stop — all eyes to Jed who’s picked this moment to marshall their mutual rage — to get them to take a breath as:

JED (CONT’D)

We took a class in how to deal

with the locals who thought we’d

overstayed our welcome…

Everyone trading looks, wondering where he’s going with this…

JED (CONT’D)

It’s ironic, but… we learned of a

guy named Mao Tse-Tung… He brought the

communists to power in China back in the 30’s.

He did it by modernizing a certain

kind of warfare. The kind where you fire a shot

or toss a grenade and then you disappear…

you blend back in… but then when the time’s

right, you bomb a roadblock… and disappear…

You keep making little gains until one day so

the theory goes — and I saw it work — your friends,

your neighbors… they start doing the same…

That’s when you know you’re on to something…

DARYL

So… what you’re saying… is that we —

JED

We should be smart, patient —

MATT

But we start killing them, right?

JED

Yeah…

(then)

And we keep doing it until they fucking leave.

Off this — the birth of an insurgency —

Anyway, one needn’t be a gun nut — nor a Sinophobe — to irrationally celebrate Red Dawn. Hipster forward operating base Alamo Drafthouse in downtown Austin played host to the film’s quiet premiere in September. There, founder Tim League dressed as Kim Jung-il (Jung-un?) — complete with “slanty eyes” glasses — to host a Red Dawn party that transformed the “Austin American Legion into a maximum-security prison for the ultimate Red Dawn shindig.” At the party, it was promised, “Prisoners will experience mandatory enjoyment from delousing stations as well as free prison tattoos and head-shaves.” Attendees were, presumably, allowed to eat and drink.

But it’s not just the East Asians who get the shaft in the new Red Dawn. An excellent early review posted at Racebending sums it up: “If you are brown, and North Korea ever invades, and your white friends decide to launch a guerrilla resistance movement, DO NOT JOIN THEM. They will get you killed. Because the Red Dawn remake really manages to off every single brown kid in the movie.” Sounds like Bill O’Reilly has a new favorite film.

Previously: Meet Mike Sui, A Dude From Wisconsin Who’s Now China’s Biggest Viral Star

Abe Sauer is the author of the book How to be: North Dakota. Email him at abesauer AT gmail.com.

Monster British Rats Immune To Poison

“A plague of mutant ‘super rats’ has invaded the upmarket town of Henley-on-Thames, the host of the annual Royal Regatta, a new study has disclosed. Researchers found the picturesque riverside Oxfordshire area has been inundated with dozens of the pests, which carry a poison-resistant gene. Having migrated from parts of Berkshire and Hampshire, the brown rats, and their life-threatening diseases, are spreading after being found on several unidentified farms.”

Assets & Liabilities: Understanding The Rolling Jubilee Project

Strike Debt, an offshoot of the Occupy movement, recently launched a project called the Rolling Jubilee, which has raised over $350K as I write; the money will be used to buy, and then forgive, around $7 million worth of distressed medical debt. That’s what a “jubilee” meant, in Old Testament times: a period for cancelling debts, and for the manumission of slaves, that came around every five decades: “And ye shall hallow the fiftieth year, and proclaim liberty throughout all the land unto all the inhabitants thereof: it shall be a jubile unto you; and ye shall return every man unto his possession, and ye shall return every man unto his family” (Leviticus 25:10, and someone might mention it to Benjamin Netanyahu.)

The highlight of the Rolling Jubilee so far was a telethon, the “People’s Bailout,” which featured speeches and performances by a passel of alt-notables including Janeane Garofalo, Lizz Winstead, Hari Kondabolu, David Rees, John Cameron Mitchell, Lee Ranaldo, Guy Picciotto, the TV on the Radio guys Kyp and Tunde, several performers and representatives from local Christian churches and a group of nuns, Sisters of St. Joseph, the latter of whom were received with the utmost bewilderment. But the star attraction was undoubtedly the famously reclusive Jeff Mangum of the Neutral Milk Hotel, who is married to Strike Debt organizer and documentary filmmaker Astra Taylor (Žižek!).

This somewhat punishing four-hour event was livestreamed on the 15th, and I watched it in a very noisy bar in Oakland.

Telethons generally make for very weird television and this was no exception, though the homegrown feeling of the production and random appearances of not-so-pro entertainers, including an impossible interpretive dancer and a little kid dressed in a matador costume, lightened things up somewhat. There were speeches, the kind where you feel as if you are trapped at a wedding, then some music, and then things got a bit heavy when Rev. Jacqui Lewis of the Middle Church Choir asked the crowd authoritatively: “How many of you know what sin means?” Well, TOTAL crickets at that point, because big schism there, all set to agree but canna go for the Jesus. O liberals, how liberal are you really.

Rev. Steve Phelps of the Riverside Church had a little better luck with the crowd. He is a smooth guy and a rawking activist. He gets himself thrown in jail as a sort of pastime. “America’s getting drunk on whine,” he said. “What’s mine is mine.” With respect to the recent election: “There was one saying what’s mine is mine, and another one saying (sometimes) something a little more complex than that.” [Fair enough.] “What’s mine is only mine by agreement which we call society. What we want to do is open up the idea that we really are only one people.” I found the Rev. Phelps very exhilarating.

The Elephant 6-inflected crowd seemed to mellow out a bit, and then came Julian Koster, formerly of Neutral Milk Hotel, and John Cameron Mitchell; then Lizz Winstead, who said a lot of baffling things, including: “Ranch dressing is a magical liquid that people ingest epically at Costco.” This seemed false, because so far as I know, you don’t eat it AT Costco.

My favorite by far was from Victor Vazquez, aka Kool A.D. of Das Racist, who performed the song “Dum Diary”: a sad meditation on the futility of U.S. culture, of materialism and the inability to break out of the cultural and political prisons we’re born to inhabit. It’s a beautiful song, weirdly philosophical, rude and savagely funny.

Is Criss Angel effeminate?

Just answer, don’t hesitate

Don’t got love? I guess you better hate

But study your mythology methodically

and tally all the odds of every Odyssey

Meanwhile, as the telethon went on, the natives were getting a little restless on Twitter.

This makes me embarrassed to be a liberal.I’m here for Jeff.#PeoplesBailout #RollingJubilee

— Rustlebones (@rustlebones) November 16, 2012

We you don’t bring out Jeff I will stain your mountaintops #RollingJubilee #StrikeDebt #PeoplesBailout #ILoveJesusChrist

— Jeff Mangum (@Jeff_Swagum) November 16, 2012

#RollingJubilee #StrikeDebt #PeoplesBailout #ILoveJesusChrist How about you pull Jeff Mangum out of thin air?

— Alex Mayer (@AlexMayer50) November 16, 2012

JEFF MANGUM!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!DO IT #RollingJubilee

— Andrew Junker (@HowToBeAndrew) November 16, 2012

Could you have more annoying hosts? #PeoplesBailout #RollingJubilee

— Andrew Junker (@HowToBeAndrew) November 16, 2012

Then came Sarah Ludwig of NEDAP, the Neighborhood Economic Development Advocacy Project, a fine speaker on the serious subject we’d all gathered for.

“This is about a financial system that is predicated on poverty and segregation. 400% payday loans. Student loans to attend sham trade schools. The failure of the state to ensure that people have the means to live.”

Jeff Mangum finally arrived, his face plunged deep in a beard so luxuriant that I thought he might bust into an acoustic version of “She’s Got Legs,” now that would have been radical, but no. All the same, it was lovely hearing him sing, I must say.

IS THERE TAX ON THAT? AND OTHER QUESTIONS

In a recent appearance on “Up with Chris Hayes,” Astra Taylor claimed that there is both a practical and a symbolic value to the Rolling Jubilee.

Hayes asked Taylor: “Are you just running a charity here, people give money, donate it, and then you forgive the debt and people will say, [about those] whose debt is being bought for five cents on the dollar — collectors have basically given up on it anyway, and can you even find the people whose debt you’re forgiving?”

The actual question went unanswered; the mechanics of the secondary market in distressed consumer debt are clear as mud, a point we’ll return to in a moment. But Taylor responded: “One of the beautiful things about this project is that it actually has concrete effects, the money raised will go to abolishing people’s medical debt […] so there will be a very concrete effect on people as a consequence. But I think an equally important part of this project is the public education campaign, and that’s where it is more radical, because our analysis is deeper.” She went on to say: “The American Dream is getting out of debt, now.”

A pithy phrase. But I can’t agree with Taylor as to the depth to Strike Debt’s analysis — at least not that part of it that has been presented to the public. There are some thorny unresolved questions with respect to the Rolling Jubilee project that none of the CPAs, lawyers or financial experts I consulted could clarify absolutely.

Let’s start with Strike Debt’s flagship publication, The Debt Resistors’ Operations Manual, an amalgam of half-baked rhetoric and non-revolutionary, standard-issue practical information for dealing with debt — order a copy of your credit report! demand corrections! and so on.

It seems to me that the authors of this document aren’t quite on the same page; partly, it seeks to encourage a wave of politically-motivated defaulters, and partly to offer immediate help and information to those who want to deal with their debts lawfully. The result feels a little seasick to me, the product of an uneasy compromise, as in this paragraph: “If you are about to default on a student loan, remember you are not alone. There are approximately 4 to 5 million other Americans that have already done so. While default can be a political act (especially when done en masse), these are the consequences you may be subject to:” (This is followed by the usual warnings of collection agencies, liability for court costs and attorneys’ fees, and so on.)

Then, The Debt Resistor’s Operations Manual fails to deliver the one piece of information its likely readership might need most: there is a real chance for debtors in bankruptcy to have some or all of their student loan debts discharged, provided they can prove “undue hardship.” The authors content themselves with this observation: “Unfortunately, bankruptcy is not an option for student debtors, except occasionally in cases of permanent disability or ‘undue hardship.’”

The conventional wisdom is that there is no discharging student debt in bankruptcy, and there’s no doubt that the odds are at present stacked against debtors. But writing in The Times in August,

Ron Lieber reported

on a 2008 study demonstrating that “57 percent of bankrupt debtors who initiated an undue hardship adversary proceeding were able to get some or all of their loans discharged.”

Now that there are 37 million student loan borrowers struggling in a tough job market, whose future prospects are very much dimmed by the specter of debt, it seems clear that these provisions are well worth revisiting — not only as a potential avenue for helping those in need, but in order to pressure Washington and the courts to refocus and amend existing laws.

Then there are the tax problems. There is a not insignificant danger that the beneficiaries of the Rolling Jubilee’s largesse will wind up owing tax on the forgiven debt. I spoke with a number of accountants and tax attorneys, and not one of them was able to give a definitive answer to this question. It is true that IRS Form 4681 states quite clearly that “generally, you do not have income from canceled debt if the cancellation or forgiveness of the debt is a gift.” Another wrinkle: there is a $13,000 tax-free limit to the amount an individual may receive as a gift; after that one pays tax. Would those who benefit from debt relief have to do so in this instance? Unknown.

The Rolling Jubilee website claims unequivocally that they will not have to issue 1099-Cs, a form that would definitely raise the possibility of tax liability for Rolling Jubilee beneficiaries. One accountant told me that the tax liability might hinge on whether or not recipients were legally indigent; it might vary considerably from case to case.

But some experts are entirely convinced that any Rolling Jubilee beneficiaries will have to pay income tax. New York tax specialist Robert Willens told Bloomberg Businessweek: “There’s not any doubt about the tax outcome at all. That’s almost always the case with debt discharges — you wind up with this tax problem that almost always mitigates the benefit of the discharge.”

Had the IRS issued a letter to the Rolling Jubilee organizers letting their beneficiaries off the hook for this potential mess, it stands to reason they would have shown it to the press. When I asked Strike Debt organizer Ann Larson directly about the tax issue, she replied, “I’m withholding comment.” I was told that I’d be unable to speak with anyone on their legal team.

HOW DISTRESSED CONSUMER DEBT WORKS

An excellent capsule analysis of how distressed consumer debt works appeared recently in a comment thread on MetaFilter. I recommend reading it in full but here are some highlights.

There are portfolios out there of debts reduced to judgment that sell for .5¢ on the dollar. Yes, that’s right, half a cent on the dollar amount. Not the dollar amount with interest, mind you, half a cent on the dollar for the amount of the judgment at the date the judgment was entered, and some of these judgments are a decade old, and have awarded interest at rates as high as 25%. The statute of limitations on money judgments in many states is really long, often 20 years or more, and they can often be renewed.

Who are these people that have these judgments entered against them that are being sold at such an absurd discount? Mostly the elderly and disabled, people with income that can’t be garnished, but there are also lots of people who have had these judgments chasing them for years, and they are afraid of participating in the legitimate economy, because as soon as they do, a skiptracer will find their employer and any disposable income will be garnished. As a result, these people hide. They stay living uncomfortable lives on disability benefits that they thought were temporary, say after a bad car accident that left them insolvent in the first place, afraid that if they try to find work again, they will just be working for their creditors forever. They remain a dependent of their common-law spouse, afraid to get married or start working for fear whoever owns the judgment now will find them. They work crappy, exploitative jobs under the table like an undocumented immigrant.

My favorite part: the real benefits of integrating fugitive debtors back into the economy.

Just $50 can buy a $10,000 judgment on someone like this who has spent every day for years hiding from life. It would cost more for the filing fees on the assignments and satisfactions of judgment than to buy these debts. Forgiving these debts would be good for the economy, removing some of the debt overhang that is like an anchor on the economy and bringing people back into the workforce, raising tax revenue and putting more money in the hands of the people most likely to put it right back into circulation.

THE MURKY, NOT-SO-LUCRATIVE MEDICAL DEBT MARKET

The secondary market for distressed consumer debt is hard to understand, in part because the rules for debt collection vary from state to state. In the case of medical debt in particular, there are weirdly interconnected relationships between hospitals and debt collectors, as evidenced by the big players in the distressed debt markets who saw the explosion of health care costs in the mid-aughts, dove into those markets expecting to see huge returns, and then leaped back out again when collections rapidly became way too complicated and unprofitable.

As a director of patient accounts for Cincinnati, Ohio-based TriHealth, Inc., put it here: “[E]xperience in the collections business did not necessarily equate to understanding the health care collection business. The niche was not a bad one — just not perhaps the easy money many appeared to think it could be.”

In order to illustrate these complexities, consider the case of a publicly traded company, the black-comically-named Accretive Health, whose board of directors boasts such luminaries as Edgar Bronfman Jr. Accretive was recently fined $2.5 million by the Minnesota state AG’s office for illegal collection tactics, “including embedding debt collectors in emergency rooms and pressuring patients to pay before receiving treatment,” The Times reported.

Their 10-K annual report is a laff riot, may I say, full of the most turbid, Orwellian doublespeak you’ve ever seen. It’s largely concerned with “managing revenue cycles,” or what would be called in English, “putting the squeeze on sick people.”

Returning to The Times report, “Carol Wall, a 53-year-old Minnesota resident, said ‘a woman with a computer cart’ told her she owed $300 as she was ‘vaginally hemorrhaging large amounts of blood’ at an Accretive-affiliated emergency room in January, according to court records.”

The point being: it’s only after the Accretives of the world get through shaking down indigent patients that their distressed debt is repackaged and sold on the secondary market. According to a 2008 Harvard study, some 62% of U.S. bankruptcies originate in medical debt.

WHO’S PROFITING OFF DEBT? A CONVERSATION WITH A STRIKE DEBT ORGANIZER

If you envision the country’s politics and policies as a radio with different channels, you might say that both the radical left and the radical right are actively seeking to snuff out all other channels but their own. But if you believe in equal rights, in the Enlightenment principles the country was founded on, then what you are protecting is the radio. Not just “your” channel. By this reckoning, Strike Debt’s stance toward conventional political activism is noticeably less hostile to a plurality of voices than many earlier anarchist movements have been, as I learned from Ann Larson, one of the aforementioned organizers of Strike Debt, and a speaker at the Rolling Jubilee. She is an adjunct English prof at Hunter College who has some student debt of her own; she’s also seeing firsthand how her students are being railroaded into an unfair debt burden. Ann’s history with Strike Debt began in the Zuccotti assemblies.

We spoke recently by phone.

Maria Bustillos: What is the ultimate goal of the Rolling Jubilee?

Ann Larson: It’s happening now. We want to start a conversation and to reveal something about the predatory debt system. Important questions about the debt market, how it works, and who it affects are now being asked. The questions are obvious. WHY does the secondary market exist? It only began in the economic context of the 1980s with the relaxation of financial regulations. People need to ask, who benefits from these circumstances? Who’s profiting?

We’re hoping to create a movement: this is one of many projects to that end. We’re provoking a conversation while at the same time doing something concrete to help people in debt.

We are asked about the moral aspects of this question: the personal responsibility that is at issue. Why does the onus fall only on the borrower here, never on the lender? People suffering under our financial system have to put groceries on credit cards because otherwise, they can’t buy food. The burden of our failing economy falls on those least able to pay. They are the most exploited. If we want to pose this in moral terms, why can’t we ask what kind of society puts people into debt when they get sick?

We don’t want to lose sight of the fact that Wall Street, the big banks, drive the debt economy. They issue credit lines in the first place; those banks then write off loans, and then they issue credit lines to buyers of the distressed debt. This is about Wall Street’s control of our lives.

Maria: Is there a fixed next step? Having started the conversation, is there a suggestion for what people might do next? A way to pressure our congressmen, for example?

Ann: There’s no script, no rules. We want to maintain the radical edge, the critique of capitalism. We’re not cutting off the possiblity for legislative reform, we’re not opposed to that, but it’s not our focus. If that happens, great. Personally, I think the solutions lie elsewhere.

THE ALLEGED LUXE LIFE OF THE 47%

Let’s be very clear. The debt the Rolling Jubilee proposes to buy and then forgive has already been written off by the issuing creditor; it no longer exists on a balance sheet anywhere. We have thus for all practical purposes already forgiven it. It’s nobody’s asset, and therefore, in a sense, it’s nobody’s liability.

Mike Konczal, the scintillatingly brilliant financial blogging wizard elsewhere known as @rortybomb, has produced what is by far (FAR) the best analysis of debt relief I’ve read anywhere in the course of these investigations, in a fantastic series at the Boston Review. So I called him up to discuss the meaning and repercussions of the Rolling Jubilee, which he’d already written about a little bit at the Roosevelt Institute blog, The Next New Deal.

“A lot of this worthless debt is skewed toward people who are at the margins of the economy,” Mike said, “and is impacting how they can live their lives. It’s functionally worthless, but has harassment value. It’s evocative to point that out.”

“That wasn’t done in the election,” I noted.

“Not at all; they don’t want to run on it. Conservatives ran on the idea that 47% have it too good. People cruisin’ by on Easy Street. Meanwhile President Obama wanted to distract from his terrible record on the housing market and housing debt in this recession.”

OBSERVERS SAY “!” AND ALSO “?”

Writers on economics and the financial markets in general crowded round the idea of the Rolling Jubilee wonderingly, as if it were a financial spacecraft or unicorn that had suddenly appeared in their midst. In the main, the pundits were tickled by the idea. Delighted by it, even. One of the most enjoyable parts of the research for this story was hearing the wonder and excitement in the voices of various accountants, economists, journos and tax lawyers as they were asked to question the most basic foundations of their own ideas about debt. Would such a contribution be treated as a gift? Would it be taxable? What did the Rolling Jubilee signify and/or portend?

Reactions varied widely. Felix Salmon appeared to become quite giddy with the implications of this project:

It’s a group of ordinary people who are perfectly happy to help banks lose 95 cents on the dollar by paying them the other 5 cents, and then forgiving the loan entirely. Of course, the banks know that some percentage of their loans will go bad, and, especially in the case of credit card debt, they will often have made a net profit on the account long before they sell off the dregs for 5 cents on the dollar. But even if the banks aren’t being hurt at all, it still feels great to have the opportunity to be an anti-bank for once. There’s something very good about forgiveness.

And then there was a Marketplace story by Sally Herships, couched in terms calculated to appeal strictly to the 1%. “Ken Smetters, an economics and public policy professor at Wharton says the [idea of the Jubilee] dates back thousands of years. The Jubliee was a time when the rich were expected to forgive the debt of the poor,” Herships exclaims pearl-clutchingly. “Smetters says people used to take out loans in the form of goats, grain or sheckel and that debt was only taken on to alleviate poverty.” (Not like now, by golly, when debt is taken on mainly for kicks, or maybe to stick it to The Man.)

This Smetters manages to pique himself on his own financial virtue, explaining to Herships that if people generally were to get the idea they didn’t have to repay their debts, he himself would never have risen out of poverty, because no bank would ever have taken the risk of loaning him, Smetters, any money. And that would be bad! There’s a “moral hazard,” he says.

Maybe I shouldn’t be so surprised that some Wharton guy appears not to get the starkly obvious fact that everybody already knows that debts, whether corporate or personal, don’t always have to be repaid. (I’m assuming the professor is not opposed to the existence of Ch. 11?) We don’t have debtors’ prisons in this country; it is exactly the flexibility of our system that allows poor ambitious guys such as Smetters once was to borrow money. If we weren’t prepared to write off bad debts, if we had no provision for bankruptcy — THEN no one would ever feel confident in taking risk, in starting a business; then we’d never be able to run an economy as complex, efficient, and daring as the one we have, with all its admitted flaws.

Later, Herships went over to the “other side” for a comment.

“When asked if a potential ethical complication was a concern for the project, Laura Hanna, an organizer with the Jubilee, had some questions of her own. ‘I guess I would ask, whether our financial market makes any sense for the majority of the population at this point. The question becomes why are we in so much personal debt?’”

Can we take it as read that business is supposed to serve the needs of society, rather than the other way around? Seriously, how hard is this?

AS WE FORGIVE OUR DEBTORS

I don’t want to give the impression that I’m not a supporter of Strike Debt: I am, very much so, and was happy to kick in a wee donation to the Rolling Jubilee. It was a fantastic, exhilarating idea and, I believe, will start a lot of balls rolling. But it will take a lot more talk, a lot of patience with one another’s opposing ideas and a lot of detailed work in order to achieve positive results. I’m looking forward to helping, where I can. There’s such big tasks ahead, in restoring fairness to the medical system, in restoring education, and the right of hard-working young people to graduate from school free of crippling debt.

In the end it was Strike Debt organizer Amin Husain, who appeared with Taylor on the Chris Hayes show, who put his finger on the real problem, the one most worth focusing on, the one pretty much everybody, on the leftish side at least, can agree on: “No one should go into debt for basic needs.”

Related: The Livestream Ended: How I Got Off My Computer And Onto The Street At Occupy Oakland

Maria Bustillos is the author of Dorkismo and Act Like a Gentleman, Think Like a Woman.

Enjoy a Pescetarian Thanksgiving, Just Like Those Old-Timey Pilgrims

My household is primarily ovo-lacto vegetarian, and I say “primarily” because I have small children who like those gross chicken lumps and fish sticks you find in your grocer’s freezer, and also because it’s nice to have a grilled, cedar-planked slab of wild-caught salmon on Thanksgiving. On the West Coast, you can do this outside on your grill, just like the Pacific Northwest tribes did for thousands of years before “Portlandia” and the Microsoft Surface tablet. In colder climates, you can broil the salmon in the oven if you don’t have a coat? But this method does create the “burning flesh” smell so loathsome to delicate souls such as Morrissey and myself, so just go outside and cook your fish.

Along with the salmon, I’m cooking an entire vegetarian (not vegan) feast that is perfectly delicious and completely satisfying without the fish. So if you’re wondering what to do for Thanksgiving and don’t do turkeys, here’s a relatively simple menu that you can start late on Thursday morning and still have a delightful table ready by 4 o’clock. (Do go to the grocery and farmer’s market before Thursday; otherwise you’re stuck with whatever the Together People picked over earlier in the week. Good bread, for example, is almost always gone by midday Wednesday, and most bakeries are closed on Thanksgiving, because people deserve a holiday.)

Here is what we’re having: Grilled & planked wild-caught sustainably fished salmon, homemade macaroni and cheese, mixed-bread baked stuffing, roasted nutmeg carrots, plain old broccoli and my famous fresh cranberry business. (I am also baking bread, because there are no bakeries within 30 miles of the desert compound where I’m spending the holiday. Otherwise I’d buy a bunch of good loaves and save baking for another, less hectic day.)

These aren’t recipes, because I don’t cook from recipes unless it’s something insanely complex, like delicate little pastries made with rosebuds and live frogs. What follows are guideposts, sort of like the Lord’s footsteps on the beach or what have you. Use them to get the essential foodstuffs and supplies piled up in your kitchen, and then “adjust to taste,” because it’s more fun that way. Dishes are listed in order of what needs to be prepared first.

Remember to buy your cedar salmon planks and soak them in water on Thanksgiving morning! They need to soak for several hours!

Famous Real Cranberry Business: Buy two bags of fresh organic cranberries, which you can only find everywhere this time of year. Also make sure you have an orange, real cane sugar, and some dusty old bourbon in the cabinet that you’re kind of not sure about. Now it is Thanksgiving Morning, hooray! Rinse your cranberries and remove the fingernails or teeth or whatever the Stephen King characters who harvested these things might’ve dropped in the bucket. Now dump the berries in a wide baking dish, grate some orange peel and drizzle a couple of ounces of bourbon over the berries, squeeze in the pulpy juice from the oranges, and spread 3/4 cup of granulated sugar over everything. Don’t use too much sugar! This is a tart, citrus-y and bourbon-y cranberry relish. You don’t want it all sickly sweet. Okay, make it a cup of sugar if you have to, it’s okay.

Now put some foil this in the oven at 250 until its bubbly, about an hour? Go ahead and have a taste of that bourbon, neat. Does it need an ice cube? Fine then! Relax, it’s only … uhh, noon already? Remove the dish, let it cool, then scoop it all into a serving bowl and stick that in the fridge until dinnertime. Looks amazing, doesn’t it?!

Mixed-Bread Baked Stuffing: This is super hearty and will be a main dish if you’re skipping the salmon. Start with two good-sized rustic boule loafs, one whole wheat and one white (sourdough if you like that), and saw these up into cubes. Day old bread is best, but anything works. Don’t get frustrated trying to make the cubes uniform. Anything reasonably bite-sized is fine; I am not ashamed to use poultry shears to cut up the bigger pieces. Put your bread “cubes” on lightly oiled baking sheets and give them a thin coat of spray olive oil. Now dust them with pepper, a mix of whatever Italian herbs in your pantry, and not too much sea salt. Bake these at 250 degrees until they’re toasted, about 10 minutes. Watch them closely! Take them out, try a few. So good! If you’re making a green salad (or having somebody make a salad while you do the “real cooking”), reserve a cup of these delicious homemade croutons for your salad.

Chop a big onion, a half-dozen garlic cloves and a half-dozen celery stalks. Get these going in a saucepan with more olive oil. When the onions are translucent (not caramelized, because that takes forever) add a liter of vegetable broth (or a vegetarian bullion cub plus water) and let that warm up while the croutons are cooling and drying. Mix it all up in a big covered baking dish, make sure there’s enough seasoning, and bake for an hour at 350F. (Depending on the density and dryness of your bread, you might need to add more vegetable broth.) You can brown it right before dinnertime, alongside the mac ‘n cheese.

Macaroni and Cheese: Baked mac ‘n cheese is a holiday specialty in the American South, so I’ve heard. (I was born and raised in the nearby autonomous zone of New Orleans, and certain regional traditions did seep through from the larger South.) Not a lot of reason to “reinvent” the dish here. It’s good, it’s simple, and it’s just time-consuming enough to be special in its own right. Pick up a 2-lb. bag of large elbow macaroni, a 2-lb. block of good medium cheddar, make sure you’ve got some milk and a couple sticks of butter in the fridge, and get ready to season this 1950s style: with salt and black pepper and paprika. (My comrade Tom Scocca believes the mac ‘n cheese should not have a sprinkle of paprika. On this, if nothing else, he is mistaken.)

Set the oven to 400F. Cook pasta until not quite ready to eat, about 10 minutes; this is going to finish in the oven. Meanwhile, grate the cheese, all of it. Don’t eat too much! Drain the macaroni and place in an oiled baking dish (you can wash out and re-use the cranberry baking dish), put two cups of milk and a half stick of butter in the pot, add a handful of salt and a few pinches of pepper and paprika, and slowly stir in half the cheese. When it’s starting to get all bubbly, pour into the dish over the pasta. Spread the rest of the grated cheese on top, dust with pepper and paprika, and bake until golden but not brown. If you leave this in for 20 minutes, both the dressing and the macaroni should be done about the same time. Then you can put these both on a rack, cover with foil and brown them when the fish is about ready.

Roasted nutmeg carrots These are so good! Buy a bunch of weird looking organic carrots at the farmers market or fancy grocery. Mixed colors and varieties, or not, doesn’t matter. Wash them, don’t scrub. Leave some Vitamin D from the soil, you need it! Brush them with olive oil, then sprinkle with brown sugar, ground nutmeg and a little cinnamon and (bonus!) saffron. Bake alongside your other dishes, for about a half hour or until fork tender. People will go nuts because these are delicious and full of unexpected flavors, plus there was that thing in the New York Times recently, so everybody will be all, “Ohhhh carrots, I read about this.”

Plain old broccoli: When you have a lot of rich and strongly seasoned dishes, it’s nice to have something that’s just what it is. Consider a bowl of steamed broccoli to be a kind of sorbet course between these other heavy dishes. Nobody’s going to say, “Wow, broccoli,” but they will appreciate it, quietly. Good fresh not-mushy steamed broccoli is also a nice color and textural element to have alongside the pink salmon.

Grilled cedar-planked salmon: It’s all about the fish here. That slimy farmed corn-fed salmon has no place on your Thanksgiving table, if you are allowing a fish on your table at all. Get wild-caught Pacific salmon, sustainably caught fish from the Pacific Northwest. Whatever species is available is going to be fantastic, whether King or Chinook or Sockeye or even Koho if you can find it. Do almost nothing to this fish. Fire up your outdoor grill, dress the salmon skin-down with lemon and rosemary and very light olive oil and chunky kosher salt and even some dried bits of pine needle (First Nations style!), open the wine, set the table, get the other dishes ready to serve because the salmon is done very quickly, and go out into the cold to grill your fish, like a hero.

If you’re using a charcoal grill, let the coals get white and then place the planks directly on top of them, no “grill” necessary. The sodden planks will keep the fish from bursting into flame. With a gas grill, just place the planks in the center and set your fire to medium-high. Stay outside with your fish, have a cigarette or another glass of bourbon, and watch carefully after eight minutes or so — the timing is very much going to depend on the thickness of your salmon fillets, and whether you’re doing one or two or three, etc. When the edges are just getting charred and the top of the fish is beginning to blister, it’s time to take it off the grill. Let it sit on the planks for another five minutes, give thanks for each other and the fine food from the Earth, and begin your feast.

Photo by WoodleyWonderWorks via Flickr Creative Commons.

Is Political Twitter Ruining All Our Inside Jokes?

“In elections past, the sort of stuff reporters joke about — Joe Biden telling a Virginia rally it could win North Carolina; Mitt Romney admiring clouds — might have ended up in pool reports, seen and appreciated only by other journalists. The Internet gives the campaign press ways to publicize the weird details that otherwise might not make it into print. The behind-the-curtain material that makes The Boys on the Bus and Fear and Loathing: On the Campaign Trail ’72 so readable is now more often than not shared with the world in real time. But in those books, weird details generally served a better understanding of a candidate’s character; on Twitter, they reduce a candidate to his stupidest moments for a quick laugh. And at a certain point (let’s say that point was when Time released photos of Paul Ryan dressed like Poochie, the ‘cool dog’ character from the ‘Simpsons’) the ‘Mystery Science Theater 3000’ routine subsumed the other part of campaign coverage, where you explain the state of the race and the issues involved to normal people.”